Chapter05IM10thEd1Finance.docx

Chapter05IM10thEd1Finance.docx

- 文档编号:8521515

- 上传时间:2023-01-31

- 格式:DOCX

- 页数:56

- 大小:316.38KB

Chapter05IM10thEd1Finance.docx

《Chapter05IM10thEd1Finance.docx》由会员分享,可在线阅读,更多相关《Chapter05IM10thEd1Finance.docx(56页珍藏版)》请在冰豆网上搜索。

Chapter05IM10thEd1Finance

CHAPTER5

TheTimeValueofMoney

CHAPTERORIENTATION

Inthischaptertheconceptofatimevalueofmoneyisintroduced,thatis,adollartodayisworthmorethanadollarreceivedayearfromnow.Thusifwearetologicallycompareprojectsandfinancialstrategies,wemusteithermovealldollarflowsbacktothepresentorouttosomecommonfuturedate.

CHAPTEROUTLINE

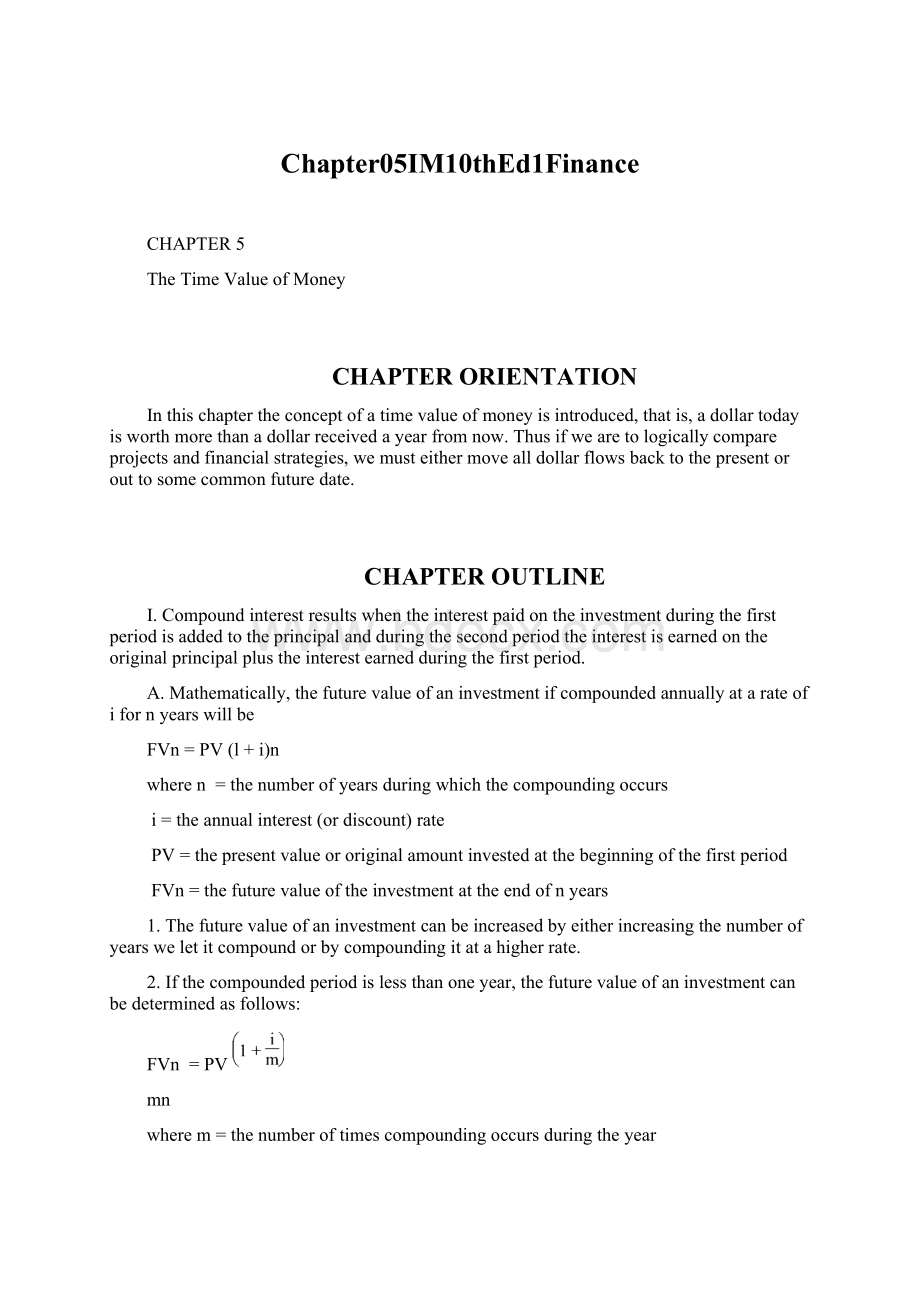

I.Compoundinterestresultswhentheinterestpaidontheinvestmentduringthefirstperiodisaddedtotheprincipalandduringthesecondperiodtheinterestisearnedontheoriginalprincipalplustheinterestearnedduringthefirstperiod.

A.Mathematically,thefuturevalueofaninvestmentifcompoundedannuallyatarateofifornyearswillbe

FVn=PV(l+i)n

wheren=thenumberofyearsduringwhichthecompoundingoccurs

i=theannualinterest(ordiscount)rate

PV=thepresentvalueororiginalamountinvestedatthebeginningofthefirstperiod

FVn=thefuturevalueoftheinvestmentattheendofnyears

1.Thefuturevalueofaninvestmentcanbeincreasedbyeitherincreasingthenumberofyearsweletitcompoundorbycompoundingitatahigherrate.

2.Ifthecompoundedperiodislessthanoneyear,thefuturevalueofaninvestmentcanbedeterminedasfollows:

FVn=PV

mn

wherem=thenumberoftimescompoundingoccursduringtheyear

II.Determiningthepresentvalue,thatis,thevalueintoday'sdollarsofasumofmoneytobereceivedinthefuture,involvesnothingotherthaninversecompounding.Thedifferencesinthesetechniquescomeaboutmerelyfromtheinvestor'spointofview.

A.Mathematically,thepresentvalueofasumofmoneytobereceivedinthefuturecanbedeterminedwiththefollowingequation:

PV=FVn

where:

n=thenumberofyearsuntilpaymentwillbereceived,

i=theinterestrateordiscountrate

PV=thepresentvalueofthefuturesumofmoney

FVn=thefuturevalueoftheinvestmentattheendofnyears

1.Thepresentvalueofafuturesumofmoneyisinverselyrelatedtoboththenumberofyearsuntilthepaymentwillbereceivedandtheinterestrate.

III.Anannuityisaseriesofequaldollarpaymentsforaspecifiednumberofyears.Becauseannuitiesoccurfrequentlyinfinance,forexample,bondinterestpayments,wetreatthemspecially.

A.Acompoundannuityinvolvesdepositingorinvestinganequalsumofmoneyattheendofeachyearforacertainnumberofyearsandallowingittogrow.

1.Thiscanbedonebyusingourcompoundingequation,andcompoundingeachoneoftheindividualdepositstothefutureorbyusingthefollowingcompoundannuityequation:

FVn=PMT

where:

PMT=theannuityvaluedepositedattheendofeachyear

i=theannualinterest(ordiscount)rate

n=thenumberofyearsforwhichtheannuitywilllast

FVn=thefuturevalueoftheannuityattheendofthenthyear

B.Pensionfunds,insuranceobligations,andinterestreceivedfrombondsallinvolveannuities.Tocomparethesefinancialinstrumentswewouldliketoknowthepresentvalueofeachoftheseannuities.

1.Thiscanbedonebyusingourpresentvalueequationanddiscountingeachoneoftheindividualcashflowsbacktothepresentorbyusingthefollowingpresentvalueofanannuityequation:

PV=PMT

where:

PMT=theannuitydepositedorwithdrawnattheendofeachyear

i=theannualinterestordiscountrate

PV=thepresentvalueofthefutureannuity

n=thenumberofyearsforwhichtheannuitywilllast

C.ThisprocedureofsolvingforPMT,theannuityvaluewheni,n,andPVareknown,isalsotheprocedureusedtodeterminewhatpaymentsareassociatedwithpayingoffaloaninequalinstallments.Loanspaidoffinthisway,inperiodicpayments,arecalledamortizedloans.HereagainweknowthreeofthefourvaluesintheannuityequationandaresolvingforavalueofPMT,theannualannuity.

IV.Annuitiesduearereallyjustordinaryannuitieswherealltheannuitypaymentshavebeenshiftedforwardbyoneyear.Compoundingthemanddeterminingtheirpresentvalueisactuallyquitesimple.Becauseanannuity,duemerelyshiftsthepaymentsfromtheendoftheyeartothebeginningoftheyear,wenowcompoundthecashflowsforoneadditionalyear.Therefore,thecompoundsumofanannuitydueis

FVn(annuitydue)=PMT(FVIFAi,n)(1+i)

A.Likewise,withthepresentvalueofanannuitydue,wesimplyreceiveeachcashflowoneyearearlier–thatis,wereceiveitatthebeginningofeachyearratherthanattheendofeachyear.Thusthepresentvalueofanannuitydueis

PV(annuitydue)=PMT(PVIFAi,n)(1+i)

V.Aperpetuityisanannuitythatcontinuesforever,thatiseveryyearfromnowonthisinvestmentpaysthesamedollaramount.

A.Anexampleofaperpetuityispreferredstockwhichyieldsaconstantdollardividendinfinitely.

B.Thefollowingequationcanbeusedtodeterminethepresentvalueofaperpetuity:

PV=

where:

PV=thepresentvalueoftheperpetuity

pp=theconstantdollaramountprovidedbytheperpetuity

i=theannualinterestordiscountrate

VI.Toaidinthecalculationsofpresentandfuturevalues,tablesareprovidedatthebackofFinancialManagement(FM).

A.ToaidindeterminingthevalueofFVninthecompoundingformula

FVn=PV(1+i)n=PV(FVIFi,n)

tableshavebeencompiledforvaluesofFVIFi,nor(i+1)ninAppendixB,"CompoundSumof$1,"inFM.

B.Toaidinthecomputationofpresentvalues

PV=FVn

=FVn(PVIFi,n)

tableshavebeencompiledforvaluesof

orPVIFi,n

andappearinAppendixCinthebackofFM.

C.Becauseofthetime-consumingnatureofcompoundinganannuity,

FVn=PMT

=PMT(FVIFAi,n)

TablesareprovidedinAppendixDofFMfor

orFVIFAi,n

forvariouscombinationsofnandi.

D.Tosimplifytheprocessofdeterminingthepresentvalueofanannuity

PV=PMT

=PMT(PVIFAi,n)

tablesareprovidedinAppendixEofFMforvariouscombinationsofnandiforthevalue

orPVIFAi,n

V.SpreadsheetsandtheTimeValueofMoney.

A.Whilethereareseveralcompetingspreadsheets,themostpopularoneisMicrosoftExcel.Justaswiththekeystrokecalculationsonafinancialcalculator,aspreadsheetcanmakeeasyworkofmostcommonfinancialcalculations.ListedbelowaresomeofthemostcommonfunctionsusedwithExcelwhenmovingmoneythroughtime:

Calculation:

Formula:

PresentValue=PV(rate,numberofperiods,payment,futurevalue,type)

FutureValue=FV(rate,numberofperiods,payment,presentvalue,type)

Payment=PMT(rate,numberofperiods,presentvalue,futurevalue,type)

NumberofPeriods=NPER(rate,payment,presentvalue,futurevalue,type)

InterestRate=RATE(numberofperiods,payment,presentvalue,futurevalue,type,guess)

where:

rate=i,theinterestrateordiscountrate

numberofperiods=n,thenumberofyearsorperiods

payment=PMT,theannuitypaymentdepositedorreceivedattheendofeachperiod

futurevalue=FV,thefuturevalueoftheinvestmentattheendofnperiodsoryears

presentvalue=PV,thepresentvalueofthefuturesumofmoney

type=whenthepaymentismade,(0ifomitted)

0=atendofperiod

1=atbeginningofperiod

guess=astartingpointwhencalculatingtheinterestrate,ifomitted,thecalculationsbeginwithavalueof0.1or10%

ANSWERSTO

END-OF-CHAPTERQUESTIONS

5-1.Theconceptoftimevalueofmoneyisrecognitionthatadollarreceivedtodayisworthmorethanadollarreceivedayearfromnoworatanyfuturedate.Itexistsbecausethereareinvestmentopportunitiesonmoney,thatis,wecanplaceourdollarreceivedtodayinasavingsaccountandoneyearfromnowhavemorethanadollar.

5-2.Compoundinganddiscountingareinverseprocessesofeachother.Incompounding,moneyismovedforwardintime,whileindiscountingmoneyismovedbackintime.Thiscanbeshownmathematicallyinthe

compoundingequation:

FVn=PV(1+i)n

Wecanderivethediscountingequationbymultiplyingeachsideof

thisequationby

andweget:

PV=FVn

5-3.Weknowthat

FVn=PV(1+i)n

Thus,anincreaseiniwillincreaseFVnandadecreaseinnwill

decreaseFVn.

5-4.BankCwhichcompoundsdailypaysthehighestinterest.Thisoccursbecause,whileallbankspaythesameinterest,5percent,bankCcompoundsthe5percentdaily.Dailycompoundingallowsinteresttobeearnedmorefrequentlythantheothercompoundingperiods.

5-5.Thevaluesinthepresentvalueofanannuitytable(Table5-8)areactuallyderivedfromthevaluesinthepresentvaluetable(Table5-4).Thiscanbeseen,byexaminingthevaluesrepresentedineachtable.Thepresentvaluetablegivesvaluesof

forvariousvaluesofiandn,whilethepresentvalueofanannuitytablegivesvaluesof

forvariousvaluesofiandn.Thusthevalueinthepresentvalueofannuitytableforann-yearannuityforanydiscountrateiismerelythesumofthefirstnvaluesinthepresentvaluetable.PVIFA10%,10yrs=6.145.

PVIF10%,n=6.144=0.909+0.826+0.751+0.683+0.621+0.564+0.513+0.467+0.424+0.386

5-6.Anannuityisaseriesofequaldollarpaymentsforaspecifiednumberofyears.Examplesofannuitiesincludemortgagepayments,interestpaymentsonbonds,fixedleasepayments,andanyfixedcontractualpayment.Aperpetuityisanannuitythatcontinuesforever,thatis,everyyearfromnowonthisinvestmentpaysthesamedollaramount.Thedifferencebetweenanannuityandaperpetuityisthataperpetuityhasnoterminationdatewhereasanannuitydoes.

SOLUTIONSTO

END-OF-CHAPTERPROBLEMS

SolutionstoProblemSetA

5-1A.(a)FVn=PV(1+i)n

FV10=$5,000(1+0.10)10

FV10=$5,000(2.594)

FV10=$12,970

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- Chapter05IM10thEd1Finance

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

铝散热器项目年度预算报告.docx

铝散热器项目年度预算报告.docx