财务管理课后答案第三章.docx

财务管理课后答案第三章.docx

- 文档编号:8231606

- 上传时间:2023-01-30

- 格式:DOCX

- 页数:39

- 大小:238.98KB

财务管理课后答案第三章.docx

《财务管理课后答案第三章.docx》由会员分享,可在线阅读,更多相关《财务管理课后答案第三章.docx(39页珍藏版)》请在冰豆网上搜索。

财务管理课后答案第三章

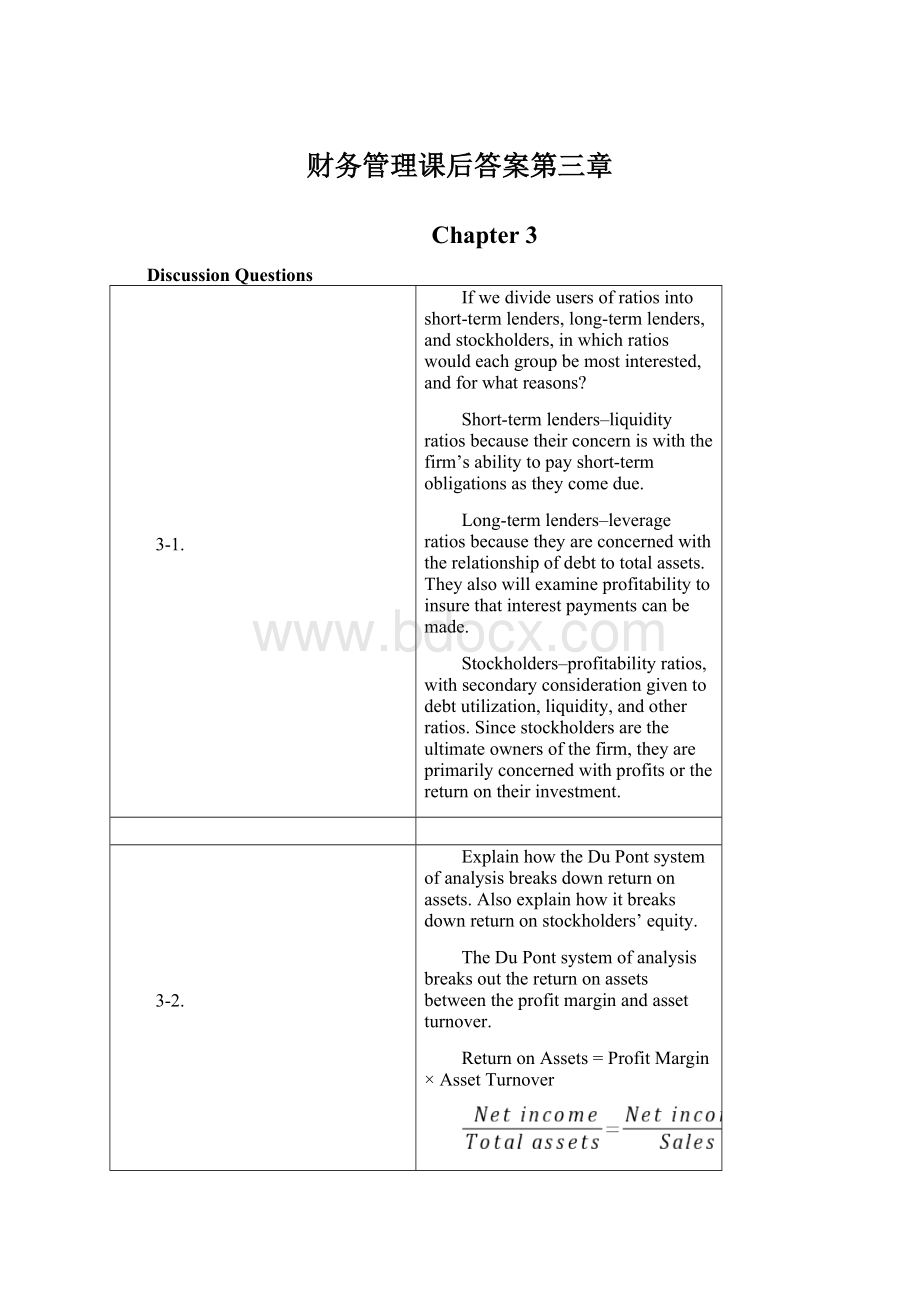

Chapter3

DiscussionQuestions

3-1.

Ifwedivideusersofratiosintoshort-termlenders,long-termlenders,andstockholders,inwhichratioswouldeachgroupbemostinterested,andforwhatreasons?

Short-termlenders–liquidityratiosbecausetheirconcerniswiththefirm’sabilitytopayshort-termobligationsastheycomedue.

Long-termlenders–leverageratiosbecausetheyareconcernedwiththerelationshipofdebttototalassets.Theyalsowillexamineprofitabilitytoinsurethatinterestpaymentscanbemade.

Stockholders–profitabilityratios,withsecondaryconsiderationgiventodebtutilization,liquidity,andotherratios.Sincestockholdersaretheultimateownersofthefirm,theyareprimarilyconcernedwithprofitsorthereturnontheirinvestment.

3-2.

ExplainhowtheDuPontsystemofanalysisbreaksdownreturnonassets.Alsoexplainhowitbreaksdownreturnonstockholders’equity.

TheDuPontsystemofanalysisbreaksoutthereturnonassetsbetweentheprofitmarginandassetturnover.

ReturnonAssets=ProfitMargin×AssetTurnover

Inthisfashion,wecanassessthejointimpactofprofitabilityandassetturnoverontheoverallreturnonassets.Thisisaparticularlyusefulanalysisbecausewecandeterminethesourceofstrengthandweaknessforagivenfirm.Forexample,acompanyinthecapitalgoodsindustrymayhaveahighprofitmarginandalowassetturnover,whileafoodprocessingfirmmaysufferfromlowprofitmargins,butenjoyarapidturnoverofassets.

ThemodifiedformoftheDuPontformulashows:

Thisindicatesthatreturnonstockholders’equitymaybeinfluencedbyreturnonassets,thedebt-to-assetsratiooracombinationofboth.Analystsorinvestorsshouldbeparticularlysensitivetoahighreturnonstockholders’equitythatisinfluencedbylargeamountsofdebt.

3-3.

Iftheaccountsreceivableturnoverratioisdecreasing,whatwillbehappeningtotheaveragecollectionperiod?

Iftheaccountsreceivableturnoverratioisdecreasing,accountsreceivablewillbeonthebooksforalongerperiodoftime.Thismeanstheaveragecollectionperiodwillbeincreasing.

3-4.

Whatadvantagedoesthefixedchargecoverageratioofferoversimplyusingtimesinterestearned?

Thefixedchargecoverageratiomeasuresthefirm’sabilitytomeetallfixedobligationsratherthaninterestpaymentsalone,ontheassumptionthatfailuretomeetanyfinancialobligationwillendangerthepositionofthefirm.

3-5.

Isthereanyvalidityinrule-of-thumbratiosforallcorporations,forexample,acurrentratioof2to1ordebttoassetsof50percent?

Norule-of-thumbratioisvalidforallcorporations.Thereissimplytoomuchdifferencebetweenindustriesortimeperiodsinwhichratiosarecomputed.Nevertheless,rules-of-thumbratiosdooffersomeinitialinsightintotheoperationsofthefirm,andwhenusedwithcautionbytheanalystcanprovideinformation.

3-6.

Whyistrendanalysishelpfulinanalyzingratios?

Trendanalysisallowsustocomparethepresentwiththepastandevaluateourprogressthroughtime.Aprofitmarginof5percentmaybeparticularlyimpressiveifithasbeenrunningonly3percentinthelasttenyears.Trendanalysismustalsobecomparedtoindustrypatternsofchange.

3-7.

Inflationcanhavesignificanteffectsonincomestatementsandbalancesheets,andthereforeonthecalculationofratios.Discussthepossibleimpactofinflationonthefollowingratios,andexplainthedirectionoftheimpactbasedonyourassumptions.

a.Returnoninvestment.

b.Inventoryturnover.

c.Fixedassetturnover.

d.Debt-to-assetsratio.

a.

Inflationmaycausenetincometobeoverstatedandtotalassetstobeunderstatedcausinganartificiallyhighratiothatismisleading.

b.

Inflationmaycausesalestobeoverstated.IfthefirmusesFIFOaccounting,inventorywillalsoreflect“inflation-influenced”dollarsandtheneteffectwillbenil.

IfthefirmusesLIFOaccounting,inventorywillbestatedinolddollarsandtoohigharatiocouldbereported.

c.

Fixedassetswillbeunderstatedrelativetotheirreplacementcostandtosalesandtoohigharatiocouldbereported.

d.

Sincebotharebasedonhistoricalcosts,nomajorinflationaryimpactwilltakeplaceintheratio.

3-8.

Whateffectwilldisinflationfollowingahighlyinflationaryperiodhaveonthereportedincomeofthefirm?

Disinflationtendstolowerreportedearningsasinflation-inducedincomeissqueezedoutofthefirm’sincomestatement.Thisisparticularlytrueforfirmsinhighlycyclicalindustrieswherepricestendtoriseandfallquickly.

3-9.

Whymightdisinflationprovetobefavorabletofinancialassets?

Becauseitispossiblethatpriorinflationarypressureswillnolongerseriouslyimpairthepurchasingpowerofthedollar,lesseninginflationalsomeansthattherequiredreturnthatinvestorsdemandonfinancialassetswillbegoingdown,andwiththislowerdemandedreturn,futureearningsorinterestshouldreceiveahighercurrentevaluation.

3-10.

Comparisonsofincomecanbeverydifficultfortwocompanieseventhoughtheysellthesameproductsinequalvolume.Why?

TherearemanydifferentmethodsoffinancialreportingacceptedbytheaccountingprofessionaspromulgatedbytheFinancialAccountingStandardsBoard.Thoughtheindustryhascontinuallytriedtoprovideuniformguidelinesandprocedures,manyoptionsremainopentothereportingfirm.Everyitemontheincomestatementandbalancesheetmustbegivencarefulattention.Twoapparentlysimilarfirmsmayshowdifferentvaluesforsales,researchanddevelopment,extraordinarylosses,andmanyotheritems.

Chapter3

Problems

1.GriffeyJuniorWear,Inc.,has$800,000inassetsand$200,000ofdebt.Itreportsnetincomeof$100,000.

a.Whatisthereturnonassets?

b.Whatisthereturnonstockholders’equity?

3-1.Solution:

GriffeyJuniorWear

a.

b.

2.HughSnoreBedding,Inc.,hasassetsof$400,000andturnsoveritsassets1.5timesperyear.Returnonassetsis12percent.Whatisitsprofitmargin(returnonsales)?

3-2.Solution:

HughSnoreBedding,Inc.

3One-Size-Fits-AllCasketCo.’sincomestatementfor2008isasfollows:

Sales$3,000,000

Costofgoodssold2,100,000

Grossprofit900,000

Sellingandadministrativeexpense450,000

Operatingprofit450,000

Interestexpense75,000

Incomebeforetaxes375,000

Taxes(30%)112,500

Incomeaftertaxes$262,500

a.Computetheprofitmarginfor2008.

b.Assumein2009,salesincreaseby10percentandcostofgoodssoldincreasesby25%.Thefirmisabletokeepallotherexpensesthesame.Onceagain,assumeataxrateof30percentonincomebeforetaxes.Whatareincomeaftertaxesandtheprofitmarginfor2009?

3-3.Solution:

OneSize-Fits-AllCasketCo.

a.Profitmarginfor2008

b.Sales$3,300,000*

Costofgoodssold2,625,000**

Grossprofit675,000

Sellingandadministrativeexpense450,000

Operatingprofit225,000

Interestexpense75,000

Incomebeforetaxes150,000

Taxes(30%)45,000

Incomeaftertaxes(2008)$105,000

*$3,000,000×1.10=$3,300,000

**$2,100,000×1.25=$2,625,000

ProfitMarginfor2009

4UsingtheDuPontmethod,evaluatetheeffectsofthefollowingrelationshipsfortheButtersCorporation.

a.ButtersCorporationhasaprofitmarginof7percentanditsreturnonassets(investment)is25.2percent.Whatisitsassetsturnover?

b.IftheButtersCorporationhasadebt-to-total-assetsratioof50percent,whatwouldthefirm’sreturnonequitybe?

c.Whatwouldhappentoreturnonequityifthedebt-to-total-assetsratiodecreasedto

35percent?

3-4.Solution:

ButtersCorporation

a.

b.

3-14.(Continued)

c.

5.AssumethefollowingdataforInteractiveTechnologyandSiliconSoftware.

InteractiveTechnology(IT)

SiliconSoftware(SS)

Netincome…………………..

$15,000

$50,000

Sales…………………………

150,000

1,000,000

Totalassets…………………..

160,000

400,000

Totaldebt…………………….

60,000

240,000

Stockholders’equity………….

100,000

160,000

a.Computereturnonstockholders’equityforbothfirmsusingratio3ainthetext.Whichfirmhasthehigherreturn?

b.Computethefollowingadditionalratiosforbothfirms.

Netincome/Sales

Netincome/Totalassets

Sales/Totalassets

Debt/Totalassets

c.Discussthefactorsfrompartbthataddedordetractedfromonefirmhavingahigherreturnonstockholders’equitythantheotherfirmascomputedinparta.

3-5.Solution

InteractiveTechnologyandSiliconSoftware

a.InteractiveSilicon

Technology(IT)Software(SS)

SiliconSoftware(SS)hasamuchhigherreturnonstockholders’equitythanInteractiveTechnology(IT).

3-5.(Continued)

b.InteractiveSilicon

Technology(IT)Software(SS)

c.Aspreviouslyindicated,SiliconSoftware(SS)hasasubstantiallyhigherreturnonstockholder’sequitythanInteractiveTechnology(IT).ThereasoniscertainlynottobefoundonreturnonthesalesdollarwhereInteractiveTechnologyhasahigherreturnthanSiliconSoftware(10%vs.5%).

However,SiliconSoftwarehasahigherreturnthanInteractiveTechnologyontotalassets(12.5%versus9.37%).Thereasonisclearlytobefoundintotalassetturnover,whichstronglyfavorsSiliconSoftwareoverInteractiveTechnology(2.5xversus.937x).Thisfactoraloneleadstothehigherreturnontotalassets.

6.PerezCorporationhasthefollowingfinancialdatafortheyears2007and2008:

2007

2008

Sales…………………………

$8,000,000

$10,000,000

Costofgoodssold……………

6,000,000

9,000,000

Inventory……………………..

800,000

1,000,000

a.Computeinventoryturnoverbasedonrationumber6,Sales/Inventory,foreachyear.

b.C

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- 财务管理 课后 答案 第三

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

铝散热器项目年度预算报告.docx

铝散热器项目年度预算报告.docx