成本会计 英文版.docx

成本会计 英文版.docx

- 文档编号:6471045

- 上传时间:2023-01-06

- 格式:DOCX

- 页数:9

- 大小:17.42KB

成本会计 英文版.docx

《成本会计 英文版.docx》由会员分享,可在线阅读,更多相关《成本会计 英文版.docx(9页珍藏版)》请在冰豆网上搜索。

成本会计英文版

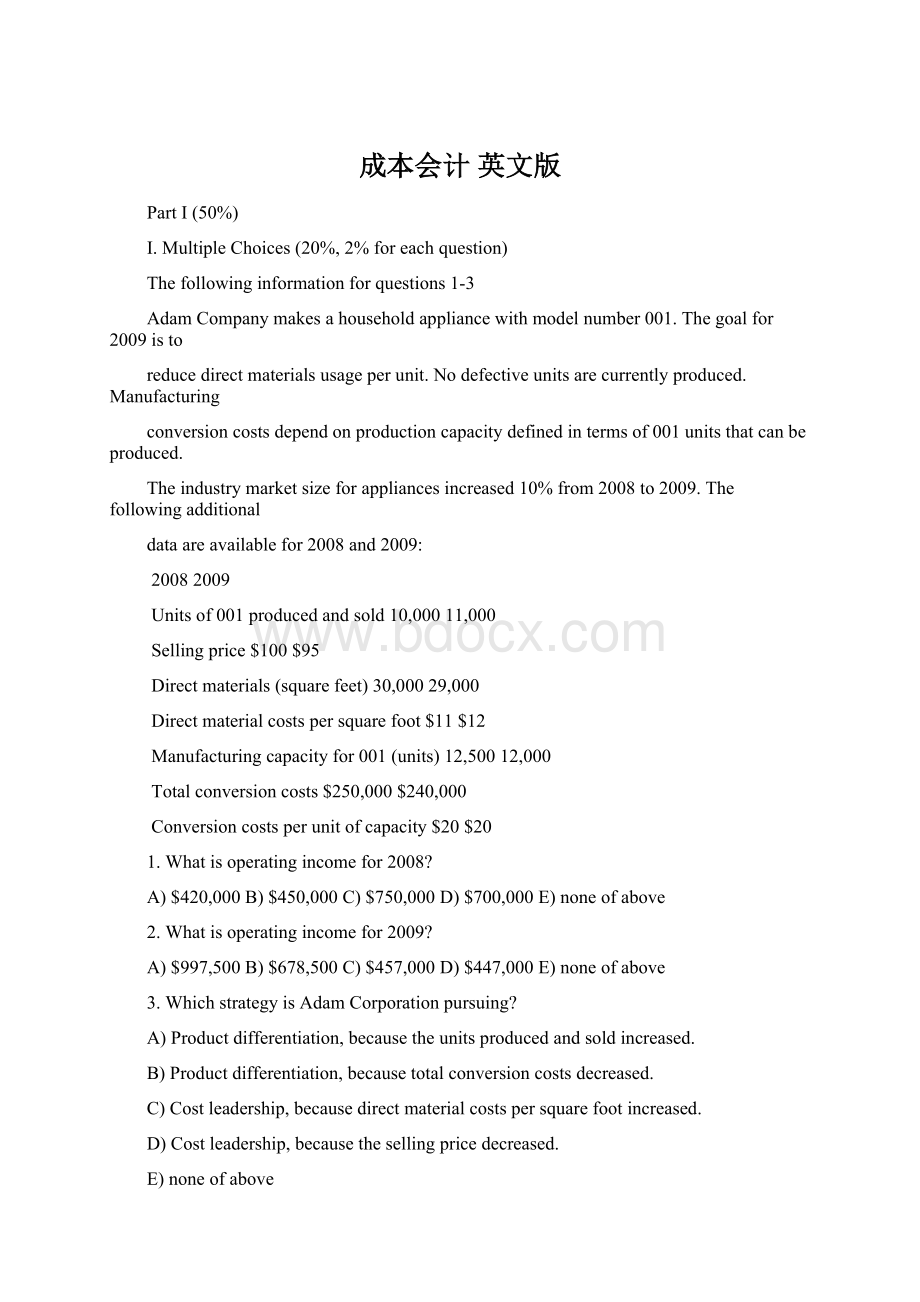

PartI(50%)

I.MultipleChoices(20%,2%foreachquestion)

Thefollowinginformationforquestions1-3

AdamCompanymakesahouseholdappliancewithmodelnumber001.Thegoalfor2009isto

reducedirectmaterialsusageperunit.Nodefectiveunitsarecurrentlyproduced.Manufacturing

conversioncostsdependonproductioncapacitydefinedintermsof001unitsthatcanbeproduced.

Theindustrymarketsizeforappliancesincreased10%from2008to2009.Thefollowingadditional

dataareavailablefor2008and2009:

20082009

Unitsof001producedandsold10,00011,000

Sellingprice$100$95

Directmaterials(squarefeet)30,00029,000

Directmaterialcostspersquarefoot$11$12

Manufacturingcapacityfor001(units)12,50012,000

Totalconversioncosts$250,000$240,000

Conversioncostsperunitofcapacity$20$20

1.Whatisoperatingincomefor2008?

A)$420,000B)$450,000C)$750,000D)$700,000E)noneofabove

2.Whatisoperatingincomefor2009?

A)$997,500B)$678,500C)$457,000D)$447,000E)noneofabove

3.WhichstrategyisAdamCorporationpursuing?

A)Productdifferentiation,becausetheunitsproducedandsoldincreased.

B)Productdifferentiation,becausetotalconversioncostsdecreased.

C)Costleadership,becausedirectmaterialcostspersquarefootincreased.

D)Costleadership,becausethesellingpricedecreased.

E)noneofabove

4.The________approachadjustsindividualjob-costrecordstoaccountforunder-allocatedor

over-allocatedoverhead.

A)adjustedallocation-rateB)prorationC)write-offtocostofgoodssold

D)BothAandBarecorrectE)noneofabove

5.Allofthefollowingareoperatingbudgetsexceptthe_____

A)purchasesbudgetB)capitalbudgetC)costofgoodssoldbudget

D)budgetedincomestatementE)noneofabove

6.ThefollowingdatafortheHebbeCompanypertaintotheproductionof2,000glasspigeons

duringJuly:

Standardvariable-overheadcost:

$6.00perpoundofglass.

Totalactualvariable-overheadcost:

$11,000.

Standardvariable-overheadcostallowedforunitsproducedwas$13,000.

Variable-overheadefficiencyvariancewas$240unfavorable

_____isthevariable-overheadflexible-budgetvariance.

A)$2,000favorableB)$240unfavorableC)$1,280favorable

D)$1,000unfavorableE)noneofabove

Thefollowinginformationforquestions7-8

HavordManufacturingusesanormalcostsystemandhadthefollowingdataavailablefor2009:

Directmaterialspurchasedonaccount$73,000

Directmaterialsrequisitioned40,000

Directlaborcostincurred65,000

Factoryoverheadincurred73,000

Costofgoodscompleted146,000

Costofgoodssold128,000

Beginningdirectmaterialsinventory13,000

BeginningWIPinventory32,000

Beginningfinishedgoodsinventory29,000

Overheadapplicationrate,asapercentofdirect-laborcosts125percent

7.Thejournalentrytorecordthematerialsplacedintoproductionwouldincludea:

A)credittoDirectMaterialsInventoryfor$40,000

B)debittoDirectMaterialsInventoryfor$74,000

C)credittoWIPInventoryfor$40,000

D)debittoWIPInventoryfor$74,000E)noneofabove

8.Theendingbalanceofwork-in-processinventoryis:

A)$219,250B)$72,250C)$65,000D)$211,000E)noneofabove

9.WhichofthefollowinginventorycostingmethodsshownbelowisrequiredbyGAAP(Generally

AcceptedAccountingPrinciples)forexternalfinancialreporting?

A)absorptioncostingB)variablecostingC)throughputcosting

D)directcostingE)noneofabove

10.WhichbudgetisNOTnecessarytopreparethebudgetedbalancesheet?

A)cashbudgetB)budgetedincomestatementC)budgetedstatementofcashflowD)revenuebudget

IIProblem

1.Followingastrategyofproductdifferentiation,NobelCorporationmakesahigh-endcomputer

monitor,OK10.NobelCorporationpresentsthefollowingdatafortheyears2008and2009:

20082009

UnitsofOK10producedandsold5,0005,500

Sellingprice$400$450

Directmaterials(pounds)15,00015,375

Directmaterialscostsperpound$40$45

ManufacturingcapacityforOK10(units)10,00010,000

Conversioncosts$1,000,000$1,100,000

Conversioncostsperunitofcapacity$100$110

Sellingandcustomer-servicecapacity(customers)6058

Totalsellingandcustomer-servicecosts$360,000$362,500

Sellingandcustomer-servicecapacitycostpercustomer$6,000$6,250

NobelCorporationproducesnodefectiveunitsbutitwantstoreducedirectmaterialsusageperunit

ofOK10in2009.Manufacturingconversioncostsineachyeardependonproductioncapacitydefined

intermsofOK10unitsthatcanbeproduced.Sellingandcustomer-servicecostsdependonthenumber

ofcustomersthatthecustomerandservicefunctionsaredesignedtosupport.NobelCorporationhas46

customersin2008and50customersin2009.Theindustrymarketsizeforhigh-endcomputermonitors

increased5%from2008to2009.

Required:

(15%)

a.Whatistherevenueeffectoftheprice-recoverycomponent?

b.Whatisthecosteffectoftheprice-recoverycomponent?

c.Whatistheneteffectonoperatingincomeasaresultoftheprice-recoverycomponent?

2.Whatarethethreecriteriaacompanyshouldusetoevaluateandchooseacostdriver?

Briefly

explaineachofthethreecriteria.(10%)

3.Whyisthebookvalueofoldequipmentirrelevanttotheequipmentreplacementdecision?

(5%)

PartII(50%)

............................................................................................

Problem

1.DYSMedicalInstrumentssells25,000unitsofMR-25,asurgicalscalpel,eachyear,whichit

purchasesfromSlocoManufacturing.Sloco’sreputationforqualityisthebestintheindustry.DYS

isnowconsideringadoptingJITpurchasing.Thepurchasepriceofeachscalpelwillincreasebya

smallamount,andmore-frequent,smallerorderswillbeplacedwithSloco.DYSexpectsthat

realistically,underJITpurchasing,therewillbestockoutsforabout4unitseachmonthandeach

stockoutwillcostabout$4tohandle.Theexpectedrelevantchangesaresummarizedhere:

Current

Purchasing

Policy

JIT

Purchasing

Policy

Numberofunitsorderedperyear

Purchasepriceperunit

Orderingcostperpurchaseorder

Numberofpurchaseordersperyear

Requiredannualrateofreturnoninvestment

Othercarryingcostsperunitperyear

Expectednumberofstockoutunitspermonth

Costperstockoutunit

25,000

$16

$3

50

20%

$5

-

-

25,000

$16.04

$3

500

20%

$5

4

$4

Required

(1)Computetheestimateddollarsavings(loss)forDYSMedicalInstrumentsfromtheadoptionof

purchasing.(12%)

2.TheJRcorporationproducesandsellsthreesoftdrinks:

Limor,ColaandOrlem.Budgetedand

actualresultsfor2009areasfollows:

Budgetfor2009

Actualfor2009

Product

SellingPriceper

Carton

VariableCostper

Carton

CartonsSold

SellingPriceper

Carton

VariableCostper

Carton

CartonsSold

Limor

$6

$4

400,000

$6.2

$4.5

480,000

Cola

$4

$2.8

600,000

$4.25

$2.75

900,000

Orlem

$7.2

$4.4

1,000,000

$6.8

$4.6

1,620,000

Thetotalsoftdrinksmarketwasestimatedtoreachsalesof25millioncartonsintheeastern

regionoftheUnitedStatesfor2009.However,actualtotalsalesvolumeintheregionwas30million

cartons.

Required:

(1)ComputethetotalsalesmixvarianceforOrlem.(5%)

(2)Computethemarket-shareandmarket-sizevariancesforJRin2009.(10%)

3.TheYWWCorporationmakeswireharnessesfortheaircraftindustry.YWWisuncertainabout

whenandhowmanycustomerorderswillbereceived.Thecompanymakesharnessesonlyafter

receivingfirmordersfromitscustomers.YWWhasrecentlypurchasedanewmachinetomaketwo

typesofwireharnesses,oneforBoeingairplanes(X7)andtheotherforAirbusIndustriesairplanes

(A3).Theannualcapacityofthenewmachineis8,450hours.Thefollowinginformationis

availablefornextyear:

Customer

Annual

average

number

oforders

Manufacturing

timerequired

Sellingpriceperorderif

averagemanufacturing

leadtimeperorderis

Variablecost

perorder

Inventory

carryingcost

perorderper

hour

Lessthan

100hours

Morethan

100hours

X7

150

40hours

$20,000

$19,400

$15,000

$0.6

A3

20

50hours

18,500

18,100

14,000

0.55

Required

(1)ComputetheaveragemanufacturingleadtimesperorderifYWWproducesbothX7andA3.

(6%)

(2)EventhoughA3hasapositivecontributionmargin,managersareevaluatingwhetherYWW

should(i)manufactureandsellonlyX7or(ii)manufactureandsellbothX7andA3.Which

alternativewillmaximizetheoperatingincomeofYWW?

Showyourcomputation.(8%)

4.Pleasefillinthefollowingblanks:

(9%)

Acompany

Revenues

Income

Investment

Incomeasapercentageofrevenues

Investmentturnover

ROI

?

?

$4,000,000

0.5%

4

?

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- 成本会计 英文版 英文

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

铝散热器项目年度预算报告.docx

铝散热器项目年度预算报告.docx