Chapter 47 Auditing Real Estate Companies.docx

Chapter 47 Auditing Real Estate Companies.docx

- 文档编号:5742467

- 上传时间:2022-12-31

- 格式:DOCX

- 页数:19

- 大小:188.92KB

Chapter 47 Auditing Real Estate Companies.docx

《Chapter 47 Auditing Real Estate Companies.docx》由会员分享,可在线阅读,更多相关《Chapter 47 Auditing Real Estate Companies.docx(19页珍藏版)》请在冰豆网上搜索。

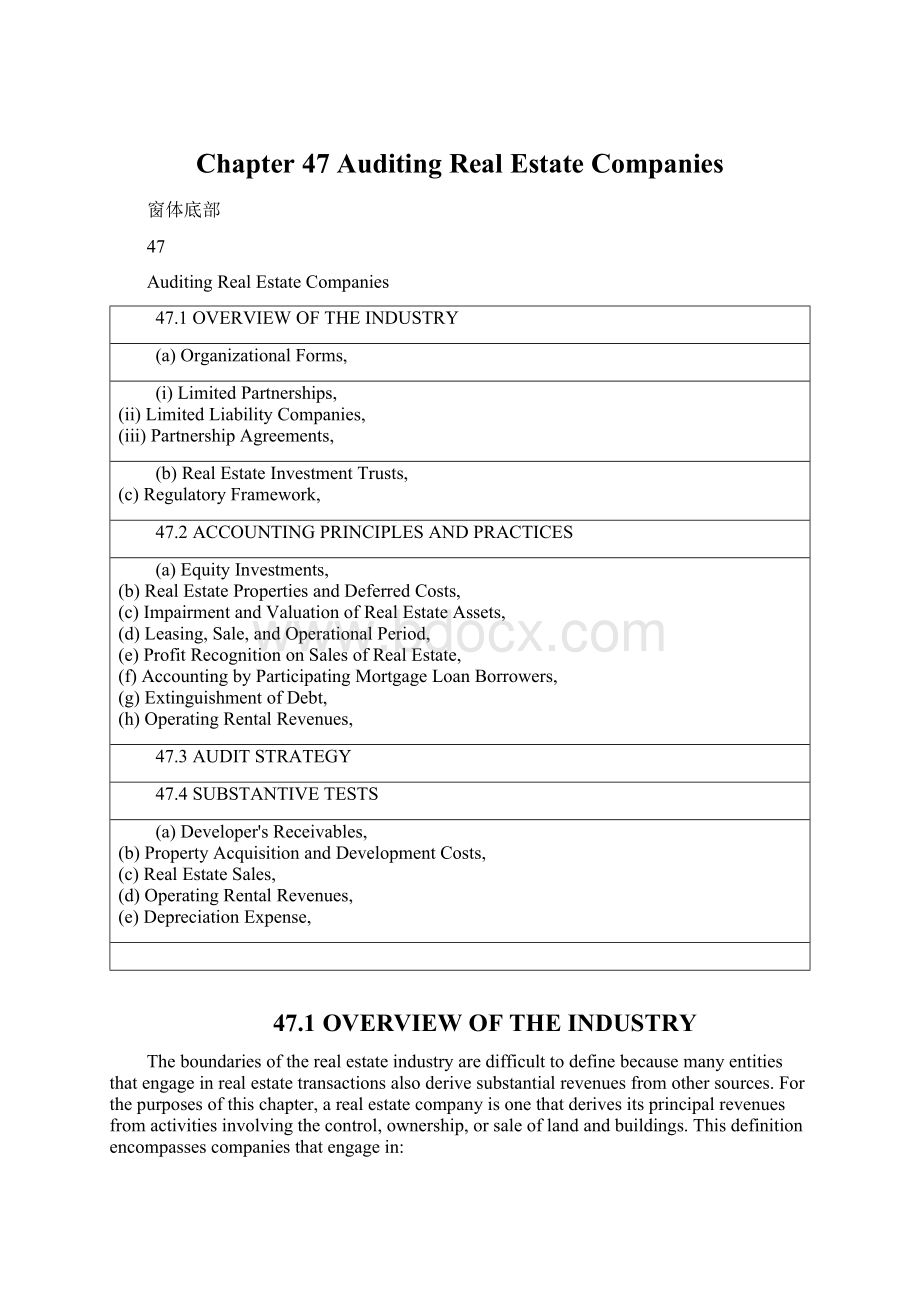

Chapter47AuditingRealEstateCompanies

窗体底部

47

AuditingRealEstateCompanies

47.1OVERVIEWOFTHEINDUSTRY

(a)OrganizationalForms,

(i)LimitedPartnerships,

(ii)LimitedLiabilityCompanies,

(iii)PartnershipAgreements,

(b)RealEstateInvestmentTrusts,

(c)RegulatoryFramework,

47.2ACCOUNTINGPRINCIPLESANDPRACTICES

(a)EquityInvestments,

(b)RealEstatePropertiesandDeferredCosts,

(c)ImpairmentandValuationofRealEstateAssets,

(d)Leasing,Sale,andOperationalPeriod,

(e)ProfitRecognitiononSalesofRealEstate,

(f)AccountingbyParticipatingMortgageLoanBorrowers,

(g)ExtinguishmentofDebt,

(h)OperatingRentalRevenues,

47.3AUDITSTRATEGY

47.4SUBSTANTIVETESTS

(a)Developer'sReceivables,

(b)PropertyAcquisitionandDevelopmentCosts,

(c)RealEstateSales,

(d)OperatingRentalRevenues,

(e)DepreciationExpense,

47.1OVERVIEWOFTHEINDUSTRY

Theboundariesoftherealestateindustryaredifficulttodefinebecausemanyentitiesthatengageinrealestatetransactionsalsoderivesubstantialrevenuesfromothersources.Forthepurposesofthischapter,arealestatecompanyisonethatderivesitsprincipalrevenuesfromactivitiesinvolvingthecontrol,ownership,orsaleoflandandbuildings.Thisdefinitionencompassescompaniesthatengagein:

∙Owningundevelopedlandforwholesaleorretailsale

∙Landdevelopment

∙Improvingandsellingrealpropertyasaprimaryproduct(e.g.,ahomebuilder)

∙Acquiringandimprovingpropertytobeheldasaninvestmentfortheproductionofcurrentincomeandforfutureappreciation

Manycompaniesareinvolvedinmorethanoneofthoseactivitiesand,inaddition,deriverevenuesfromavarietyofancillaryservicesassociatedwithrealestate,suchasfinancing,propertymanagement,insurance,subcontracting,andbrokerage.Inaddition,anumberofothertypesofbusinesses,suchasbrokerage,leasing,management,andfinancing,arecloselyassociatedwithrealestateownershipandoperations.

(a)OrganizationalForms

Companiesintherealestateindustryareorganizedundervariouslegalforms,includingsoleproprietorships,limitedpartnerships,limitedliabilitycompanies,generalpartnerships,corporations,jointventures,andtrusts.Theformoforganizationisgovernedlargelybytheobjectivesofthebusiness.Forexample,acontractororbuildernormallyselectsthecorporateformoforganizationtoobtainthebenefitsoflimitedliabilitybecauseofthebusinessrisksassociatedwiththistypeofoperation.Ownersofanindividualprojectmayorganizeasalimitedpartnershiptoobtainthebenefitsofbothlimitedliabilityforthepassiveinvestorsandthepass-throughoftaxlossesthatmaybedeductibleincertainsituations.

Realestateisparticularlysensitivetochangesineconomicconditions,andrealestatecompaniesusuallyavoidassemblinglargecentralstaffsandmakingheavycapitalinvestments,sothatoverheadcanbereducedtoaminimumduringdifficulteconomictimes.

(i)LimitedPartnerships.Thelimitedpartnershipformoforganizationisespeciallywellsuitedtorealestateventures.Ithasmanyofthefavorabletaxattributesofageneralpartnership,butprovideslimitedliabilityforthelimitedpartners.Theselimitedpartnersgenerallyareresponsibleonlyforthecapitalthattheyhavecommittedtothepartnership,althoughinsomeinstancestheymayberequiredtoreturncashpreviouslywithdrawnfromthepartnership.Thelimitedpartnershipformenablesthegeneralpartners,whoareusuallydevelopers,toobtainequityfromoutsidesourcesforrealestateprojectsandmaypermitlimitedpartnerstoselltheirinterests(e.g.,thetradingunitsinamasterlimitedpartnership),thusprovidingthelimitedpartnerswithliquidity.

Investorsinalimitedpartnershipreceiveashareofthepartnershiplosses,whichtheycanusetooffsettaxableincomefromothersourcesincertaincircumstances.Incomefromthesaleofrealestateresultsinacapitalgain,whichreceivespreferentialtaxtreatment.UndertheTaxReformActof1986(TRA86),lossesfromaninvestmentinalimitedpartnershipareclassifiedaspassivelossesthatcanoffsetonlyotherpassiveincomeandmaysubjecttheinvestortothealternativeminimumtax.

(ii)LimitedLiabilityCompanies.Manystateshavepassedlegislationallowingfortheformationoflimitedliabilitycompanies.Theseorganizationsprovidemembers(shareholders)withtheprotectionofacorporationbutfortaxpurposesaretreatedaspartnerships.Theadvantageofalimitedliabilitycompanyoveralimitedpartnershipisthatitprovidestheshareholderswhofunctionasgeneralpartnerswiththesamelimitedliabilityasthosewhofunctionaslimitedpartners.Thistypeoforganizationeventuallymaybecomethepreferredmethodofownershipofrealestate.

(iii)PartnershipAgreements.Thepartnershipagreementisasignificantdocumentforrealestatecompaniesorganizedaspartnerships.Theagreementidentifiesthescopeofactivitiesinwhichthepartnershipmayoperate,setsforththepartnership'stermofexistence,definestheconditionsunderwhichthepartnershipmaybeterminatedordissolvedbeforethestatedterminationdate,anddetailstherespectivepartners'rightsandresponsibilities.Theagreementaffectsnotonlytheaccountingforthepartnership,butalsotheprofitrecognizedbythedeveloper/generalpartner.Thefollowingprovisionsofatypicalpartnershipagreementareofparticularinteresttotheauditor:

∙CapitalContributionsandBorrowings.Theagreementsetsforththetotalamountofthepartner'sinvestmentandthepaymentscheduleonwhichcapitalcontributionsaretobemade.Theamountandtimingofcontributionsmateriallyaffectboththeinvestor'sreturnontheinvestmentandthecostoftheproject.Normally,aninvestorisrequiredtosignapromissorynoteforthecapitalcontributionsthatarepayableafterthedateofadmission.Termsofdefaultandremediesforthegeneralpartnersaredefined,andnormallytheuseofallcapitalcontributionsisspecifiedinthepartnershipagreement.Mostagreementsalsograntthepartnershiptherighttoborrowmoneyfromothersourcesandestablishcertainrequirementsforandlimitationsonsuchborrowings.

∙CapitalAccounts,ProfitsandLosses,CashFlow,andDistributions.Theagreementstatestheaccountingmethod(cashoraccrual)andthefiscalyearofthepartnership(whichisnormallyacalendaryear).Cashflowandprofitsandlossesnormallyaredefined,andthemethodofallocationamongpartnersisstated.Inaddition,theallocationofgainorlossandoftheproceedsonasaleoftheprojectandthedistributionofproceedsfromarefinancingarespecified.

∙RightsandResponsibilitiesofPartners.Theagreementdefinestherightsandresponsibilitiesofthelimitedpartners.Limitedpartnersusuallyhavetherighttocallmeetings,voteforamendmentstothelimitedpartnershipagreement,andvoteforremovalorsubstitutionofthegeneralpartners;participationinmanagementbythelimitedpartnersusuallyisprohibited.Inaddition,theagreementsetsforththegeneralpartners'responsibilitiesformanagingthepartnership.Thesegenerallyincludethepowertoappointthemanaginggeneralpartnerandtherighttoacquirepropertyandtoexecuteamortgagenote,constructioncontract,managementagreement,andotherdocumentsrequiredinconnectionwiththeconstructionandoperationoftheproject.Inaddition,theagreementgenerallyspecifieswhetheranauditorreviewoffinancialstatementswillbeprovidedwithinaspecifiedtimeframe.Themostrelevantprovisionsfromtheauditor'sviewpointrelatetothegeneralpartners'righttopayorreceivespecifiedfeesascompensationfororganizinganddevelopingthepartnershipandformanagingtheconstructionphaseoftheproject.Alsosignificantarethegeneralpartners'obligationstoinitiateandsupportrentaloperations.Usuallythegeneralpartnersandmanaginggeneralpartnerdonotreceiveanycompensationformanagingtheaffairsofthepartnershipintheircapacityasgeneralpartners.Theymay,however,receivefeesthroughrelatedparties,suchasmanagementfeestoaffiliatedmanagementcompanies,forprovidingservicesotherthanthosethatarepartoftheirroleasgeneralpartners.

Thespecifictermsofpartnershipagreementsvarywidely.Theauditorshouldbefamiliarwiththepartnershipagreementtodeterminewhethertheaccountingprinciplesappliedbythepartnershipareinconformitywiththeagreement,andwhetherthegeneralandlimitedpartnershavecompliedwiththerestrictiveprovisionsoftheagreement.Thetermsofthepartnershipagreementcansignificantlyaffecttheamountandtimingoftheprofitadeveloper/generalpartnermayrecognizeonatransactionwiththepartnership.

(b)RealEstateInvestmentTrusts

RealEstateInvestmentTrusts(REITs)arecorporationsthatallowinvestorstopurchasestockatastatedpricepershare.Thestockmaybelistedonanexchangeandactivelytraded,thusprovidinginvestorsameansofliquidity.Aninvestorgenerallyreceivesadividendeachyear,sincetheREITrulesrequirethat95percent(90%commencingin2001)oftaxableearningsbedistributed.IncomefromaREITisconsideredportfolioincomeandthuscannotbeusedtooffsetpassivelosses.

AcommontypeofentitythatholdsrealestateisknownasanUmbrellaPartnershipRealEstateInvestmentTrust(UPREIT).AnUPREITisanoperatingpartnershipthatownspropertyandhasaREITasitssolegeneralpartner.Thesellerofpropertyhasanoptiontoreceiveoperatingpartnershipinterests(units)orsharesinthe

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- Chapter 47 Auditing Real Estate Companies

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

对中国城市家庭的教育投资行为的理论和实证研究.docx

对中国城市家庭的教育投资行为的理论和实证研究.docx