ACCA p6 fa10 新增知识点.docx

ACCA p6 fa10 新增知识点.docx

- 文档编号:29920713

- 上传时间:2023-08-03

- 格式:DOCX

- 页数:44

- 大小:63.35KB

ACCA p6 fa10 新增知识点.docx

《ACCA p6 fa10 新增知识点.docx》由会员分享,可在线阅读,更多相关《ACCA p6 fa10 新增知识点.docx(44页珍藏版)》请在冰豆网上搜索。

ACCAp6fa10新增知识点

4Employmentincome-Part2

Section1.Personalservicecompanies(PSCs):

Section1.1Introduction:

∙Thereareanti-avoidanceruleswhichpreventworkersavoidingincometaxandnationalinsurancecontributionsbyofferingtheirservicesthroughanintermediary,suchasapersonalservicecompany(IR35provisions).

∙TheeffectoftheIR35provisionsisthatasalarypaymentmaybedeemedtohavebeenmadetotheworkerattheendofthetaxyearwhichwillbesubjecttoPAYEandNICinthenormalway.

Section1.2Calculationofdeemedemploymentpayment:

∙Onlytakeintoaccountincomefrom‘relevantengagements’(i.e.wheretheworkerwouldhavebeenanemployeeoftheclientiftheyhadnotusedaPSC).

∙Anumberofdeductionscanbetaken,e.g.5%flatrate,actualsalary,benefitsandemployer'sNIConsalaryandbenefits.

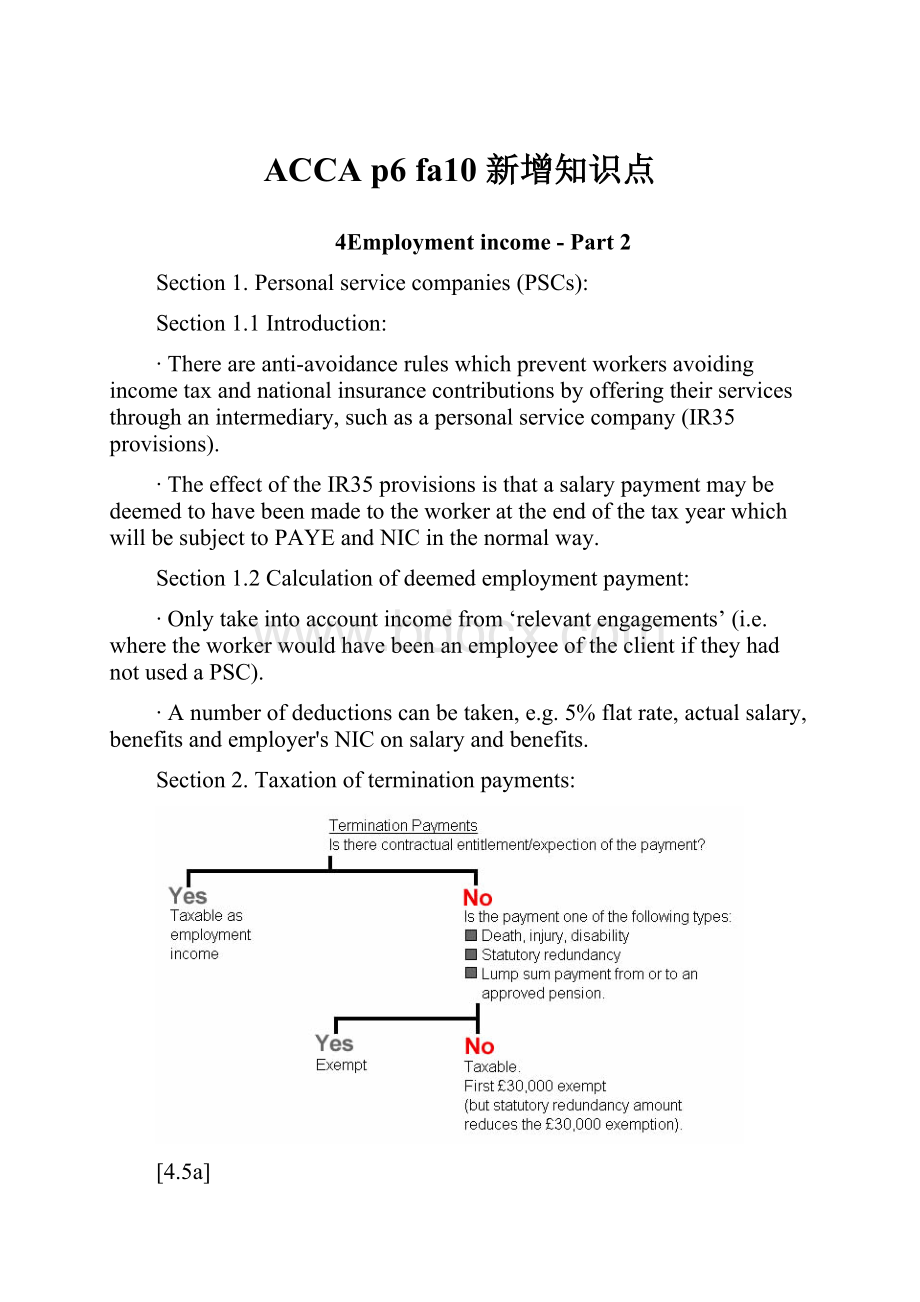

Section2.Taxationofterminationpayments:

[4.5a]

Section3.Shareoptions:

Section3.1Generalinformation:

Thereare3stagesforanyshareoption:

1.Grant:

Theemployergrantstheemployeetherighttopurchasesharesatafuturedateatapricesetatdateofgrant.

2.Exercise:

Theemployeeexercisestherightgrantedatstage1andpurchasestheshares.

3.Sale:

Theemployeesellsthesharespurchasedatstage2.

∙Whereshareoptionsareprovidedtoemployeesthetaximplicationswilldependonwhethertheschemewasapprovedorunapproved.

Section3.2Approvedcompanyshareoptionplans:

∙Canberestrictedtoselectfewemployees.

∙Maximumvalueofoptions£30,000.

∙Optionsmustbeexercisedbetween3and10years.

∙Noincometaxchargeongrantandexerciseoftheoption(providedatMV).

∙Capitalgainstaxmaybepayableondisposaloftheshares.

Section3.3Unapprovedshareoptions:

∙Noqualifyingconditions.

∙Noincometaxchargeongrant.

∙Incometaxchargeonexercise.

∙Capitalgainstaxmaybepayableondisposaloftheshares.

Section3.4AApprovedsavingsrelatedshareoptionscheme(SAYE):

∙Anothertypeofapprovedscheme.

∙Opentoallemployees.

∙Employeessavebetween£5and£250(monthly).

∙Contractfor3or5years.

∙Taxfreebonusattheend.

∙Thesavingscanbeusedtobuyshares.

∙Capitalgainstaxmaybepayableondisposaloftheshares.

Section3.4BEnterprisemanagementinitiativescheme(EMI):

∙Anothertypeofapprovedscheme.

∙Appliestoqualifyingcompaniesonlyi.e.broadlysatisfyingEISconditions.

∙Optionmustbeexercisedwithin10years.

∙Maximumvalueofoptions£120,000.

∙Maximumtotalvalueofoptionsforcompany£3m.

∙Noincometaxchargeongrantoftheoption.

∙Noincometaxchargeonexerciseoftheoption(providedgrantedatMV).

∙Capitalgainstaxmaybepayableondisposalofthesharesgranted.

Section4.Shareincentiveplans(SIPs):

∙Thisschememustbeavailabletoallemployees.

∙Freesharesworth£3,000canbegiventotheemployeebytheemployer.

∙Partnershipsharescanbeboughtbytheemployeewithpre-taxsalaryuptotheloweroff10%ofsalaryand£1,500.

∙Foreachpartnershipsharepurchased2matchingsharescanbegiven.

∙Tobecompletelyincometaxfree,thefreeshares,partnershipsharesandmatchingsharesmustbeheldintheplanforatleastfiveyears.

∙Dividendsofupto£1,500aretax-freeiftheyareusedtobuyadditionalshareswhicharethenheldintheplanforatleast3years.

∙ACGTchargewillarisewhenthesharesaresold.

5EISandVCT

Theenterpriseinvestmentscheme(EIS)–Incometaxrelief:

Conditionsfortheinvestor

∙Theinvestormustsubscribeforshareswhollyincash.

∙Forincometaxpurposestheinvestormustnotbeconnectedwiththecompany,iethroughemploymentorowningmorethan30%inthecompany.

Theenterpriseinvestmentscheme(EIS)–Incometaxrelief:

Conditionsforthecompany

∙Thecompanymustbeanunquotedtradingcompany.

∙Thefundsraisedmustbeusedbythatcompanytocarryoutaqualifyingtrade.

∙Atleast80%ofthemoneyraisedbytheEISshareissuemustbeusedwithin12monthsoftheshareissue.

∙Thegrossassetsofthecompanymustnotexceed£7mpriortonor£8maftertheinvestment.

∙Eligiblesharesmustbenewordinarysharesissuedforgenuinecommercialreasons.

∙Thequalifyingcompanymusthavefewerthan50fulltimeemployeeswhenthesharesareissued.

∙Thequalifyingcompanymusthaveraisednomorethan£2minthe12monthsendingonthedateoftherelevantinvestment.

Theenterpriseinvestmentscheme(EIS)–Incometaxrelief:

Taxreduction

∙Theinvestorreceivesataxreduction.

∙20%×amountsubscribed.

∙Maximuminvestmentqualifyingforincometaxrelief=£500,000.

Theenterpriseinvestmentscheme(EIS)–Incometaxrelief:

CarryingbackEISrelief

∙Ifsharesareissuedatanytimewithinthethetaxyeartheinvestormayclaimtohavethesharestreatedasissuedinthepreviousyear.

Theenterpriseinvestmentscheme(EIS)–Incometaxrelief:

WithdrawalofEISrelief

∙Thesharesmustbeheldforatleast3yearsotherwisetherelief,iethetaxreduction,iswithdrawnandtaxedasincomeintheyearthesharesaresold:

∙Ifthedisposalisnotatmarketvaluetransactionthefullamountofthereliefiswithdrawn,or

∙Ifthedisposalisatmarketvalue,theamountwithdrawnisbasedontheconsiderationreceived.

TheEnterpriseinvestmentscheme(EIS)–CGTrelief:

Exemptionforgains

∙IfsharesthatqualifyforEISincometaxreliefareheldforatleast3years,anygainarisingonthedisposalofthesharesisexemptfromCGT.

∙Ifthesharesaresoldwithin3yearsthegainiscomputedinthenormalway.

TheEnterpriseinvestmentscheme(EIS)–CGTrelief:

Capitallosses

∙AcapitallossarisingfromthedisposalofEISsharescanbesetagainsttheinvestor's:

∙Gains,or

∙Generalincome.

TheEnterpriseinvestmentscheme(EIS)–CGTrelief:

EISCGTdeferralrelief

∙EISdeferralreliefallowsaninvestortodeferchargeablegainsonthedisposalofanyasset.

∙IfEISreliefandentrepreneursreliefarebothavailabletheinvestorchooseswhichofthetwotobeclaimed.

∙TheEISsharesmustbepurchasedintheperiodoneyearbeforeorthreeyearsafterthedisposal.

∙ForCGTpurposestheinvestorcanbe'connected'withcompany(iethroughemployment,orbyholding>30%oftheshares).

Venturecapitaltrusts(VCTs):

VCTincometaxrelief

∙Theinvestorisentitledtoataxreductionof30%×amountinvested(maximum£200,000).

∙Dividendsreceivedaretaxfreeincome.

Venturecapitaltrusts(VCTs):

Conditions

∙VCTsarelistedcompaniesthatinvestinunquotedtradingcompaniesandmeetcertainconditions.

∙TheVCT'sincomemustcomemainlyfromsharesorsecurities.

∙Atleast70%ofitsinvestmentsmustbesharesinqualifyingholdings.

∙Atleast30%ofitsholdingsmustbeinordinaryshares.

∙Thequalifyingcompanymusthavefewerthan50fulltimeemployeeswhenthesharesareissued.

∙Aninvestmentlimitof£2mapplies.Thismeansthequalifyingcompanymusthaveraisednomorethan£2minthe12monthsendingonthedateoftherelevantinvestment.

Venturecapitaltrusts(VCTs):

Withdrawalofincometaxrelief

∙Thesharesmustbeheldforatleast5yearsotherwisetherelief,iethetaxreduction,iswithdrawnandtaxedasincomeintheyearthesharesaresold:

∙Ifthedisposalisnotatmarketvalue,thefullamountofthereliefiswithdrawn,or

∙Ifthedisposalisatmarketvalue,theamountwithdrawnisbasedontheconsiderationreceived×30%.

VCTCGTexemption

∙CapitalgainsonthesaleofsharesintheVCTareexempt.

13Capitalgainstax(individuals)-part2

Transfersbetweenconnectedpersons

∙Closerelatives(butnotuncles,auntsandcousins)areconnectedpersonsforCGTpurposes.

∙DisposalproceedsarealwaysdeemedtobeMV.

∙Lossescanonlybesetagainstgainsonothertransferstothesameconnectedperson.

Transfersbetweenspousesandcivilpartners

∙Takeplaceatnogain/noloss.

Incorporationrelief:

Overview

∙Ifaperson(soletraderorpartnership)transfershisbusinesstoacompany,heistreatedashavingmadeadisposalofthebusinessassetsforCGTpurposes.

∙Saleproceeds=Marketvalueoftheassetsatthedateofincorporation.

∙Thekeybenefitofthisreliefistoenablegainsarisingonincorporationofabusinesstobedeferredintothebasecostofthesharesacquired.

∙Thereliefisautomatic,sonoclaimneedstobemade.

∙Anindividualmustspecificallyelectnottoreceiveincorporationrelief.

Incorporationrelief:

Conditionsforincorporationrelieftoapply

∙Thebusinessistransferredasagoingconcern.

∙Allitsassets(otherthancash)aretransferredtothecompany.

∙Theconsiderationiswhollyorpartlyinshares.

Incorporationrelief:

Computingincorporationrelief

∙Step1:

Computethenetchargeablegain:

oForeachchargeablebusinessasset.

oSaleproceedsequalthemarketvalueatthedateofincorporation.

oNetoffthegainsandlossesoneachasset.

£

Marketvalueatincorporation

X

Lessoriginalcost

(X)

Gainbeforeentrepreneurs'relief

X

[13.7a]

∙Step2:

Deductincorporationrelief:

£

Totalgainsfromchargeablebusinessassets

X

Lessincorporationrelief:

Totalvalueofsharesreceived

×Totalgains=Incorporationrelief

(Totalvalueofshares+cash+loanstock)

(X)

ChargeableGain

X

[13.7b]

oFullincorporationreliefwillbeavailableifalltheconsiderationconsistsofshares.

oHowever,wherepartoftheconsiderationcomprisecashand/orloanstock,incorporationreliefwillberestrictedtotheshareelement.

∙Step3:

Reducethebasecostoftheshares:

£

Marketvalueofshares

X

Lessincorporat

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- ACCA p6 fa10 新增知识点 新增 知识点

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

《贝的故事》教案4.docx

《贝的故事》教案4.docx