国际金融FinanceTestBank4教学文案Word文档格式.docx

国际金融FinanceTestBank4教学文案Word文档格式.docx

- 文档编号:22266687

- 上传时间:2023-02-03

- 格式:DOCX

- 页数:23

- 大小:22.88KB

国际金融FinanceTestBank4教学文案Word文档格式.docx

《国际金融FinanceTestBank4教学文案Word文档格式.docx》由会员分享,可在线阅读,更多相关《国际金融FinanceTestBank4教学文案Word文档格式.docx(23页珍藏版)》请在冰豆网上搜索。

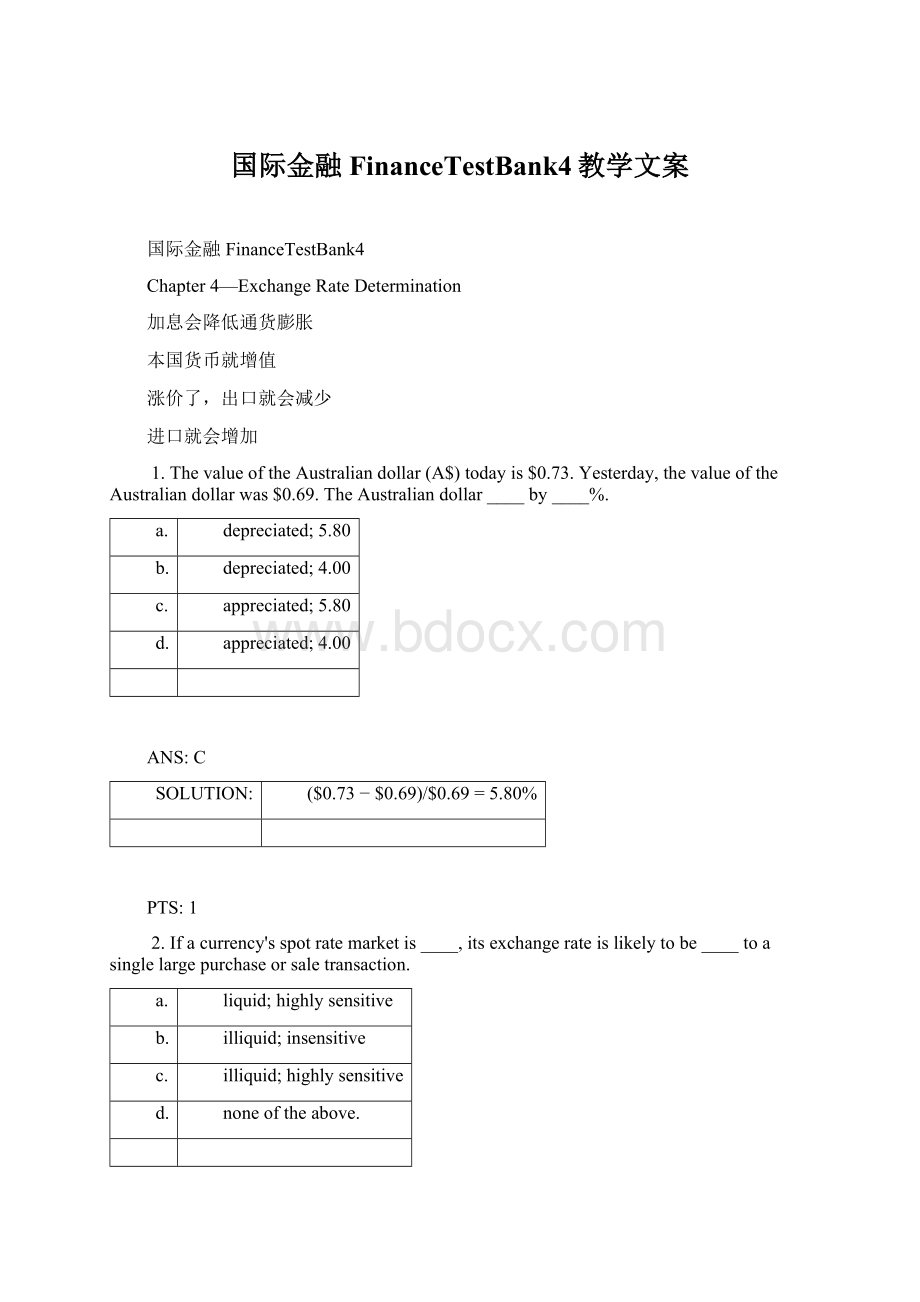

C

SOLUTION:

($0.73−$0.69)/$0.69=5.80%

PTS:

1

2.Ifacurrency'

sspotratemarketis____,itsexchangerateislikelytobe____toasinglelargepurchaseorsaletransaction.

liquid;

highlysensitive

illiquid;

insensitive

noneoftheabove.

CPTS:

3.____isnotafactorthatcausescurrencysupplyanddemandschedulestochange.

Relativeinflationrates

Relativeinterestrates

Relativeincomelevels

Expectations

e.

Alloftheabovearefactorsthatcausecurrencysupplyanddemandschedulestochange.

EPTS:

4.AlargeincreaseintheincomelevelinMexicoalongwithnogrowthintheU.S.incomelevelisnormallyexpectedtocause(assumingnochangeininterestratesorotherfactors)a(n)____inMexicandemandforU.S.goods,andtheMexicanpesoshould____.

increase;

appreciate

depreciate

decrease;

BPTS:

5.AnincreaseinU.S.interestratesrelativetoGermaninterestrateswouldlikely____theU.S.demandforeurosand____thesupplyofeurosforsale.

reduce;

increase

reduce

APTS:

6.InvestorsfromGermany,theUnitedStates,andtheU.K.frequentlyinvestineachotherbasedonprevailinginterestrates.IfBritishinterestratesincrease,Germaninvestorsarelikelytobuy____dollar-denominatedsecurities,andtheeuroislikelyto____relativetothedollar.

fewer;

more;

7.Whenthe"

real"

interestrateisrelativelylowinagivencountry,thenthecurrencyofthatcountryistypicallyexpectedtobe:

weak,sincethecountry'

squotedinterestratewouldbehighrelativetotheinflationrate.

strong,sincethecountry'

squotedinterestratewouldbelowrelativetotheinflationrate.

DPTS:

8.AssumethattheinflationratebecomesmuchhigherintheU.K.relativetotheU.S.Thiswillplace____pressureonthevalueoftheBritishpound.Also,assumethatinterestratesintheU.K.begintoriserelativetointerestratesintheU.S.Thechangeininterestrateswillplace____pressureonthevalueoftheBritishpound.

upward;

downward

upward

downward;

9.Ingeneral,whenspeculatingonexchangeratemovements,thespeculatorwillborrowthecurrencythatisexpectedtoappreciateandinvestinthecountrywhosecurrencyisexpectedtodepreciate.

a.True

b.False

FPTS:

10.BaylorBankbelievestheNewZealanddollarwillappreciateoverthenextfivedaysfrom$.48to$.50.Thefollowingannualinterestratesapply:

Currency

LendingRate

BorrowingRate

Dollars

7.10%

7.50%

NewZealanddollar(NZ$)

6.80%

7.25%

BaylorBankhasthecapacitytoborroweitherNZ$10millionor$5million.IfBaylorBank'

sforecastiscorrect,whatwillitsdollarprofitbefromspeculationoverthefive-dayperiod(assumingitdoesnotuseanyofitsexistingconsumerdepositstocapitalizeonitsexpectations)?

$521,325.

$500,520.

$104,262.

$413,419.

$208,044.

E

1.

Borrow$5million.

2.

ConverttoNZ$:

$5,000,000/$.48=NZ$10,416,667.

3.

InvesttheNZ$atanannualizedrateof6.80%overfivedays.

NZ$10,416,667⋅[1+6.80%(5/360)]

=NZ$10,426,505

4.

ConverttheNZ$backtodollars:

NZ$10,426,505⋅$.50=$5,213,252

5.

Repaythedollarsborrowed.Therepaymentamountis:

$5,000,000⋅[1+7.5%(5/360)]

=$5,000,000⋅[1.00104]

=$5,005,208

6.

Afterrepayingtheloan,theremainingdollarprofitis:

$5,213,252−$5,005,208=$208,044

11.AssumethefollowinginformationregardingU.S.andEuropeanannualizedinterestrates:

U.S.Dollar($)

6.73%

7.20%

Euro(€)

7.28%

TrensorBankcanborroweither$20millionor€20million.Thecurrentspotrateoftheeurois$1.13.Furthermore,TrensorBankexpectsthespotrateoftheeurotobe$1.10in90days.WhatisTrensorBank'

sdollarprofitfromspeculatingifthespotrateoftheeuroisindeed$1.10in90days?

$579,845.

$583,800.

$588,200.

$584,245.

$980,245.

A

Borrow€20million.

Convertthe€20millionto€20,000,000⋅$1.13=$22,600,000.

Investthe$22,600,000atanannualizedrateof6.73%for90days.

$22,600,000⋅[1+6.73%(90/360)]

=$22,980,245

Determineeurosowed:

€20,000,000⋅[1+7.28%(90/360)]=€20,364,000.

Determinedollarsneededtorepayeuroloan:

€20,364,000⋅$1.10=$22,400,400.

Thedollarprofitis$22,980,245−$22,400,400=$579,845.

12.Theequilibriumexchangerateofpoundsis$1.70.Atanexchangerateof$1.72perpound:

U.S.demandforpoundswouldexceedthesupplyofpoundsforsaleandtherewouldbeashortageofpoundsintheforeignexchangemarket.

U.S.demandforpoundswouldbelessthanthesupplyofpoundsforsaleandtherewouldbeashortageofpoundsintheforeignexchangemarket.

U.S.demandforpoundswouldexceedthesupplyofpoundsforsaleandtherewouldbeasurplusofpoundsintheforeignexchangemarket.

U.S.demandforpoundswouldbelessthanthesupplyofpoundsforsaleandtherewouldbeasurplusofpoundsintheforeignexchangemarket.

U.S.demandforpoundswouldbeequaltothesupplyofpoundsforsaleandtherewouldbeashortageofpoundsintheforeignexchangemarket.

13.AssumethatSwissinvestorshavefrancsavailabletoinvestinsecurities,andtheyinitiallyviewU.S.andBritishinterestratesasequallyattractive.NowassumethatU.S.interestratesincreasewhileBritishinterestratesstaythesame.Thiswouldlikelycause:

theSwissdemandfordollarstodecreaseandthedollarwilldepreciateagainstthepound.

theSwissdemandfordollarstoincreaseandthedollarwilldepreciateagainsttheSwissfranc.

theSwissdemandfordollarstoincreaseandthedollarwillappreciateagainsttheSwissfranc.

theSwissdemandfordollarstodecreaseandthedollarwillappreciateagainstthepound.

14.Therealinterestrateadjuststhenominalinterestratefor:

exchangeratemovements.

incomegrowth.

inflation.

governmentcontrols.

noneoftheabove

15.IfU.S.inflationsuddenlyincreasedwhileEuropeaninflationstayedthesame,therewouldbe:

anincreasedU.S.demandforeurosandanincreasedsupplyofeurosforsale.

adecreasedU.S.demandforeurosandanincreasedsupplyofeurosforsale.

adecreasedU.S.demandforeurosandadecreasedsupplyofeurosforsale.

anincreasedU.S.demandforeurosandadecreasedsupplyofeurosforsale.

16.IfinflationinNewZealandsuddenlyincreasedwhileU.S.inflationstayedthesame,therewouldbe:

aninwardshiftinthedemandscheduleforNZ$andanoutwardshiftinthesupplyscheduleforNZ$.

anoutwardshiftinthedemandscheduleforNZ$andaninwardshiftinthesupplyscheduleforNZ$.

anoutwardshiftinthedemandscheduleforNZ$andanoutwardshiftinthesupplyscheduleforNZ$.

aninwardshiftinthedemandscheduleforNZ$andaninwardshiftinthesupplyscheduleforNZ$.

17.IftheU.S.andJapanengageinsubstantialfinancialflowsbutlittletrade,____directlyinfluencestheirexchangeratethemost.IftheU.S.andSwitzerlandengageinmuchtradebutlittlefinancialflows,____directlyinfluencestheirexchangeratethemost.

interestratedifferentials;

interestratedifferentials

inflationandinterestratedifferentials;

incomeandinterestratedifferentials;

inflationdifferentials

inflationandincomedifferentials

inflationandincomedifferentials;

18.IfinflationincreasessubstantiallyinAustraliawhileU.S.inflationremainsunchanged,thisisexpectedtoplace____pressureonthevalueoftheAustraliandollarwithrespecttotheU.S.dollar.

upward

downward

eitherupwardordownward(dependingonthedegreeoftheincreaseinAustralianinflation)

noneoftheabove;

therewillbenoimpact

19.AssumethatBritishcorporationsbegintopurchasemoresuppliesfromtheU.S.asaresultofseverallaborstrikesbyBritishsuppliers.Thisactionreflects:

anincreaseddemandforBritishpounds.

adecreaseinthedemandforBritishpounds.

anincreaseinthesupplyofBritishpoundsforsale.

adecreaseinthesupplyofBritishpoundsforsale.

20.Theexchangeratesofsmallercountriesareverystablebecausethemarketfortheircurrencyisveryliquid.

21.Thephrase"

thedollarwasmixedi

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- 国际金融 FinanceTestBank4 教学 文案

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

广东省普通高中学业水平考试数学科考试大纲Word文档下载推荐.docx

广东省普通高中学业水平考试数学科考试大纲Word文档下载推荐.docx