OECD税收协定范本中英对照文本Word格式文档下载.docx

OECD税收协定范本中英对照文本Word格式文档下载.docx

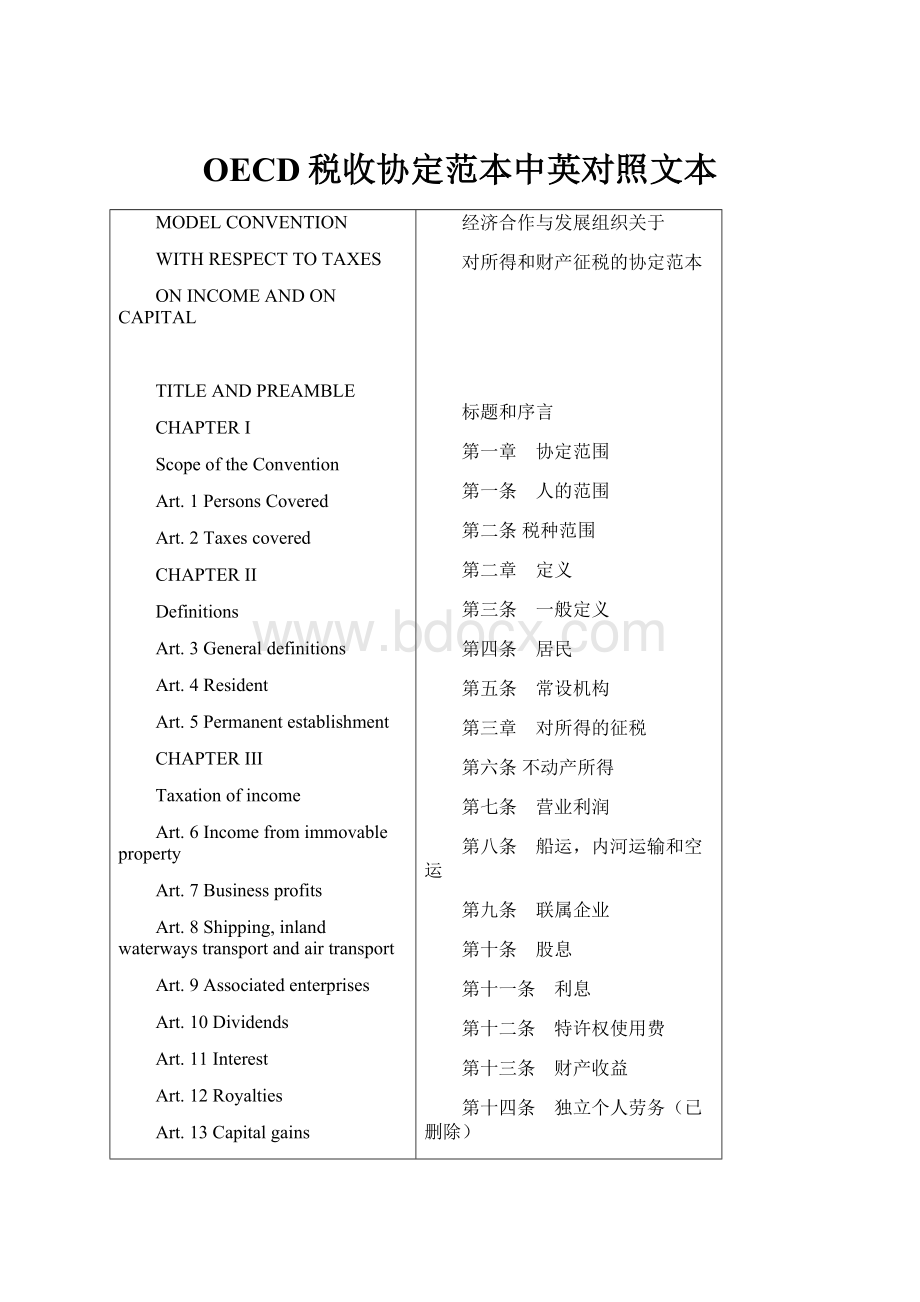

- 文档编号:21996713

- 上传时间:2023-02-02

- 格式:DOCX

- 页数:36

- 大小:39.20KB

OECD税收协定范本中英对照文本Word格式文档下载.docx

《OECD税收协定范本中英对照文本Word格式文档下载.docx》由会员分享,可在线阅读,更多相关《OECD税收协定范本中英对照文本Word格式文档下载.docx(36页珍藏版)》请在冰豆网上搜索。

Art.5Permanentestablishment

CHAPTERIII

Taxationofincome

Art.6Incomefromimmovableproperty

Art.7Businessprofits

Art.8Shipping,inlandwaterwaystransportandairtransport

Art.9Associatedenterprises

Art.10Dividends

Art.11Interest

Art.12Royalties

Art.13Capitalgains

Art.14[Deleted]

Art.15Incomefromemployment

Art.16Directors’fees

Art.17Artistesandsportsmen

Art.18Pensions

Art.19GovernmentService

Art.20Students

Art.21Otherincome

CHAPTERIV

Taxationofcapital

Art.22Capital

CHAPTERV

Methodsforeliminationofdoubletaxation

Art.23AExemptionmethod

Art.23BCreditmethod

CHAPTERVI

Specialprovisions

Art.24Non-discrimination

Art.25Mutualagreementprocedure

Art.26Exchangeofinformation

Art.27Assistanceinthecollectionoftaxes

Art.28Membersofdiplomaticmissionsandconsularposts

Art.29Territorialextension

CHAPTERVII

Finalprovisions

Art.30Entryintoforce

Art.31Termination

TITLEOFTHECONVENTION

Conventionbetween(StateA)and(StateB)

withrespecttotaxesonincomeandoncapital1

PREAMBLETOTHECONVENTION2

1.Stateswishingtodosomayfollowthewidespreadpracticeofincludinginthetitleareferencetoeithertheavoidanceofdoubletaxationortoboththeavoidanceofdoubletaxationandthepreventionoffiscalevasion.

2.ThePreambleoftheConventionshallbedraftedinaccordancewiththeconstitutionalprocedureofbothContractingStates.

SCOPEOFTHECONVENTION

Article1

PERSONSCOVERED

ThisConventionshallapplytopersonswhoareresidentsofoneorbothoftheContractingStates.

Article2

TAXESCOVERED

1.ThisConventionshallapplytotaxesonincomeandoncapitalimposedonbehalfofaContractingStateorofitspoliticalsubdivisionsorlocalauthorities,irrespectiveofthemannerinwhichtheyarelevied.

2.Thereshallberegardedastaxesonincomeandoncapitalalltaxesimposedontotalincome,ontotalcapital,oronelementsofincomeorofcapital,includingtaxesongainsfromthealienationofmovableorimmovableproperty,taxesonthetotalamountsofwagesorsalariespaidbyenterprises,aswellastaxesoncapitalappreciation.

3.TheexistingtaxestowhichtheConventionshallapplyareinparticular:

a)(inStateA):

..........................................

b)(inStateB):

4.TheConventionshallapplyalsotoanyidenticalorsubstantiallysimilartaxesthatareimposedafterthedateofsignatureoftheConventioninadditionto,orinplaceof,theexistingtaxes.ThecompetentauthoritiesoftheContractingStatesshallnotifyeachotherofanysignificantchangesthathavebeenmadeintheirtaxationlaws.

DEFINITIONS

Article3

GENERALDEFINITIONS

1.ForthepurposesofthisConvention,unlessthecontextotherwiserequires:

a)theterm"

person"

includesanindividual,acompanyandanyotherbodyofpersons;

b)theterm"

company"

meansanybodycorporateoranyentitythatistreatedasabodycorporatefortaxpurposes;

c)theterm"

enterprise"

appliestothecarryingonofanybusiness;

d)theterms"

enterpriseofaContractingState"

and"

enterpriseoftheotherContractingState"

meanrespectivelyanenterprisecarriedonbyaresidentofaContractingStateandanenterprisecarriedonbyaresidentoftheotherContractingState;

e)theterm"

internationaltraffic"

meansanytransportbyashiporaircraftoperatedbyanenterprisethathasitsplaceofeffectivemanagementinaContractingState,exceptwhentheshiporaircraftisoperatedsolelybetweenplacesintheotherContractingState;

f)theterm"

competentauthority"

means:

(i)(inStateA):

................................

(ii)(inStateB):

g)theterm"

national"

inrelationtoaContractingState,means:

(i)anyindividualpossessingthenationalityorcitizenshipofthatContractingState;

and

(ii)anylegalperson,partnershiporassociationderivingitsstatusassuchfromthelawsinforceinthatContractingState;

h)theterm"

business"

includestheperformanceofprofessionalservicesandofotheractivitiesofanindependentcharacter.

2.AsregardstheapplicationoftheConventionatanytimebyaContractingState,anytermnotdefinedthereinshall,unlessthecontextotherwiserequires,havethemeaningthatithasatthattimeunderthelawofthatStateforthepurposesofthetaxestowhichtheConventionapplies,anymeaningundertheapplicabletaxlawsofthatStateprevailingoverameaninggiventothetermunderotherlawsofthatState.

Article4

RESIDENT

1.ForthepurposesofthisConvention,theterm"

residentofaContractingState"

meansanypersonwho,underthelawsofthatState,isliabletotaxthereinbyreasonofhisdomicile,residence,placeofmanagementoranyothercriterionofasimilarnature,andalsoincludesthatStateandanypoliticalsubdivisionorlocalauthoritythereof.Thisterm,however,doesnotincludeanypersonwhoisliabletotaxinthatStateinrespectonlyofincomefromsourcesinthatStateorcapitalsituatedtherein.

2.Wherebyreasonoftheprovisionsofparagraph1anindividualisaresidentofbothContractingStates,thenhisstatusshallbedeterminedasfollows:

a)heshallbedeemedtobearesidentonlyoftheStateinwhichhehasapermanenthomeavailabletohim;

ifhehasapermanenthomeavailabletohiminbothStates,heshallbedeemedtobearesidentonlyoftheStatewithwhichhispersonalandeconomicrelationsarecloser(centreofvitalinterests);

b)iftheStateinwhichhehashiscentreofvitalinterestscannotbedetermined,orifhehasnotapermanenthomeavailabletohimineitherState,heshallbedeemedtobearesidentonlyoftheStateinwhichhehasanhabitualabode;

c)ifhehasanhabitualabodeinbothStatesorinneitherofthem,heshallbedeemedtobearesidentonlyoftheStateofwhichheisanational;

d)ifheisanationalofbothStatesorofneitherofthem,thecompetentauthoritiesoftheContractingStatesshallsettlethequestionbymutualagreement.

3.Wherebyreasonoftheprovisionsofparagraph1apersonotherthananindividualisaresidentofbothContractingStates,thenitshallbedeemedtobearesidentonlyoftheStateinwhichitsplaceofeffectivemanagementissituated.

Article5

PERMANENTESTABLISHMENT

permanentestablishment"

meansafixedplaceofbusinessthroughwhichthebusinessofanenterpriseiswhollyorpartlycarriedon.

2.Theterm"

includesespecially:

a)aplaceofmanagement;

b)abranch;

c)anoffice;

d)afactory;

e)aworkshop,and

f)amine,anoilorgaswell,aquarryoranyotherplaceofextractionofnaturalresources.

3.Abuildingsiteorconstructionorinstallationprojectconstitutesapermanentestablishmentonlyifitlastsmorethantwelvemonths.

4.NotwithstandingtheprecedingprovisionsofthisArticle,theterm"

shallbedeemednottoinclude:

a)theuseoffacilitiessolelyforthepurposeofstorage,displayordeliveryofgoodsormerchandisebelongingtotheenterprise;

b)themaintenanceofastockofgoodsormerchandisebelongingtotheenterprisesolelyforthepurposeofstorage,displayordelivery;

c)themaintenanceofastockofgoodsormerchandisebelongingtotheenterprisesolelyforthepurposeofprocessingbyanotherenterprise;

d)themaintenanceofafixedplaceofbusinesssolelyforthepurposeofpurchasinggoodsormerchandiseorofcollectinginformation,fortheenterprise;

e)themaintenanceofafixedplaceofbusinesssolelyforthepurposeofcarryingon,fortheenterprise,anyotheractivityofapreparatoryorauxiliarycharacter;

f)themaintenanceofafixedplaceofbusinesssolelyforanycombinationofactivitiesmentionedinsubparagraphsa)toe),providedthattheoverallactivityofthefixedplaceofbusinessresultingfromthiscombinationisofapreparatoryorauxiliarycharacter.

5.Notwithstandingtheprovisionsofparagraphs1and2,whereaperson—otherthananagentofanindependentstatustowhomparagraph6applies—isactingonbehalfofanenterpriseandhas,andhabituallyexercises,inaContractingStateanauthoritytoconcludecontractsinthenameoftheenterprise,thatenterpriseshallbedeemedtohaveapermanentestablishmentinthatStateinrespectofanyactivitieswhichthatpersonundertakesfortheenterprise,unlesstheactivitiesofsuchpersonarelimitedtothosementionedinparagraph4which,ifexercisedthroughafixedplaceofbusiness,wouldnotmakethisfixedplaceofbusinessapermanentestablishmentundertheprovisionsofthatparagraph.

6.AnenterpriseshallnotbedeemedtohaveapermanentestablishmentinaContractingStatemerelybecauseitcarriesonbusinessinthatStatethroughabroker,generalcommissionagentoranyotheragentofanindependentstatus,providedthatsuchpersonsareactingintheordinarycourseoftheirbusiness.

7.ThefactthatacompanywhichisaresidentofaContractingStatecontrolsoriscontrolledbyacompanywhichisaresidentoftheotherContractingState,orwhichcarriesonbusinessinthatotherState(whetherthroughapermanentestablishmentorotherwise),shallnotofitselfconstituteeithercompanyapermanentestablishmentoftheother.

TAXATIONOFINCOME

Article6

INCOMEFROMIMMOVABLEPRO

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- OECD 税收 协定 范本 中英对照 文本

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

广东省普通高中学业水平考试数学科考试大纲Word文档下载推荐.docx

广东省普通高中学业水平考试数学科考试大纲Word文档下载推荐.docx