美国会计准则 中国会计准则 中国企业所得税简明对比表 英文版docWord文档格式.docx

美国会计准则 中国会计准则 中国企业所得税简明对比表 英文版docWord文档格式.docx

- 文档编号:20306779

- 上传时间:2023-01-21

- 格式:DOCX

- 页数:24

- 大小:28.30KB

美国会计准则 中国会计准则 中国企业所得税简明对比表 英文版docWord文档格式.docx

《美国会计准则 中国会计准则 中国企业所得税简明对比表 英文版docWord文档格式.docx》由会员分享,可在线阅读,更多相关《美国会计准则 中国会计准则 中国企业所得税简明对比表 英文版docWord文档格式.docx(24页珍藏版)》请在冰豆网上搜索。

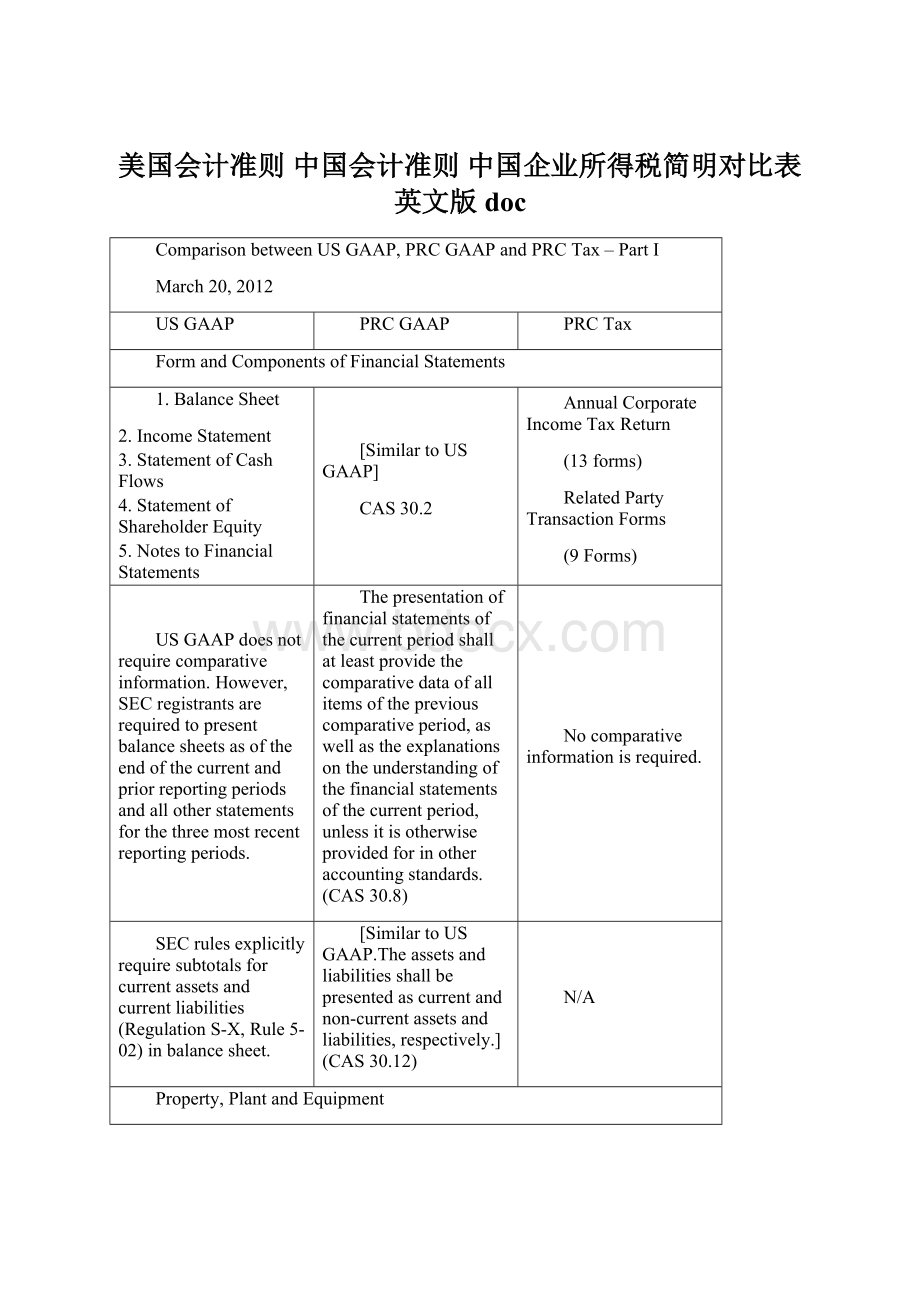

AnnualCorporateIncomeTaxReturn

(13forms)

RelatedPartyTransactionForms

(9Forms)

USGAAPdoesnotrequirecomparativeinformation.However,SECregistrantsarerequiredtopresentbalancesheetsasoftheendofthecurrentandpriorreportingperiodsandallotherstatementsforthethreemostrecentreportingperiods.

Thepresentationoffinancialstatementsofthecurrentperiodshallatleastprovidethecomparativedataofallitemsofthepreviouscomparativeperiod,aswellastheexplanationsontheunderstandingofthefinancialstatementsofthecurrentperiod,unlessitisotherwiseprovidedforinotheraccountingstandards.(CAS30.8)

Nocomparativeinformationisrequired.

SECrulesexplicitlyrequiresubtotalsforcurrentassetsandcurrentliabilities(RegulationS-X,Rule5-02)inbalancesheet.

[SimilartoUSGAAP.Theassetsandliabilitiesshallbepresentedascurrentandnon-currentassetsandliabilities,respectively.](CAS30.12)

N/A

Property,PlantandEquipment

Property,plantandequipmentisrecognizedinitiallyatcost.

[SimilartoUSGAAP](CAS4.7)

[SimilartoUSGAAP](CITLawI/R56)

Property,plantandequipmentisdepreciatedoveritsusfullife.

●Straightlinemethod

●Decliningbalancemethod

●Sum-of-the-years'

-digitsmethod

●Depreciationbasedonuse(activity)

[SimilartoUSGAAP](CAS4.17)

OnlydeprecitioncomputedbystraightlinemethodisdeductibleforCITpurpose.(CITLawI/R59)

[Temporarydifference]

Anitemofproperty,plantandequipmentisdepreciatedevenifitisidle,butnotifitisheldforsale.

Landisalsonotdepreciated.

[SimilartoUSGAAP.InvestmentProperty–Buildingisnotdepreciated(aHFSasset)]

(CAS4.14)

Landisnotdepreciated.(CAS4.14)

Idlefixedassets(otherthanbuildings)andfixedassetsthatisnotrelatedtobusinessarenotdepreciated.

Landaccountedforasafixedassetisnotdepreciated.(CITLaw11)

Estimatesofusefullifeandresidualvalue,andthemethodofdepreciationarereviewedonlywheneventsorchangesincircumstancesindicatethatthecurrentestimatesordepreciationmethodarenolongerappropriate.

Anychangesareaccountedforprospectivelyasachangeinestimate.

Anenterpriseshall,atleastattheendofeachyear,haveacheckontheusefullife,expectednetsalvagevalue,andthedepreciationmethodofthefixedassets.(CAS4.19)

[SimilartoUSGAAP](CAS4.19)

Residualvalueoffixedassetscannotbechangedoncedetermined.

(CITLawI/R59)

Subsequentexpenditureiscapitalizedonlywhenitisprobablethatitwillgiverisetofutureeconomicbenefits.

[SimilartoUSGAAP](CAS4.6)

Comprehensiverepaircostforfixedassetsshouldbecapitalizedandamortizedovernolessthan3years.

(CITLaw13,CITLawI/R70)

Therevaluationofproperty,plantandequipmentisnotpermitted.

[FollowPRCGAAP](CITLawI/R56)

Thegainorlossondisposalisthedifferencebetweenthenetproceedsreceivedandthecarryingamountoftheasset.

[SimilartoUSGAAP.Inaddition,relevanttaxexpensesarealsodeductibleincomputingthedisposalgainorloss.](CAS4.6)

DisposalgainistaxableforCIT.

Disposallossneedstobereportedtotaxauthoritybeforededuction,ifthedisposedfixassethasreachedorexceededitsusefullife.

Saleslossatfairvalueinnormalbusinessoperationsneedstobereportedtotaxauthoritybeforededuction.

Forotherlossesoffixedassets,thetaxauthority’sapprovalshallberequiredfordeduction.

(SATOrder[2011]No.25)

IntangibleAssetsandGoodwill

Intangibleassetsaremeasuredinitiallyatfairvalue.

Theintangibleassetsshallbeinitiallymeasuredaccordingtoitscost.(CAS6.12)

Intangibleassetscannotberevalued.

[SimilartoUSGAAP](CAS6.12)

Goodwillisrecognizedonlyinabusinesscombinationandismeasuredasaresidual.

[SimilartoUSGAAP]CAS20.13

[FollowPRCGAAP]

Goodwillandotherintangibleassetswithindefiniteusefullivesarenotamortized,butinsteadaresubjecttoimpairmenttestingatleastannually.

"

Reversal"

ofimpairmentlossisnotallowed.

[SimilartoUSGAAP]CAS6.19

[SimilartoUSGAAP]CAS8.17

Intangibleassetsthatarenotrelatedtobusinesscannotbeamortized.

(CITLaw12)

Intangibleassetswithfiniteusefullivesareamortizedovertheirexpectedusefullives.

[SimilartoUSGAAP]CAS6.17

Intangibleassetsshouldbeamortizedbystraightlinemethodovernolessthan10yearsorovercontractualperiod.

(CITLawI/R67)

Subsequentexpendituresonanintangibleassetisnotcapitalizedunlessitcanbedemonstratedthattheexpenditureincreasestheutilityoftheasset.

Itonlyspecifiessubsequentexpenditureson“R&

D”projects.[R-expense;

D-capitalized](CAS6.10)

Borrowigcostcouldbecapitalized.

(CITLawI/R37)

Bothinternalresearchanddevelopmentexpenditureisexpensedasincurred.Specialcapitalizationcriteriaapplytoin-processR&

Dacquiredinabusinesscombination,direct-responseadvertising,softwaredevelopedforinternaluseandsoftwaredevelopedforsaletothirdparties.

Theresearchexpendituresforitsinternalresearchanddevelopmentprojectsofanenterpriseshallbeexpensedincurrentperiod.(CAS6.8)

Thedevelopmentexpendituresforitsinternalresearchanddevelopmentprojectsofanenterprisemaybecapitalizedasintangibleassets(CAS6.9)

Thetaxpositionofself-developedintangibleassetsfollowsPRCGAAP(development)plusanyexpenditurestobringtheassetstoexpectedconditionbeingreadyforuse.(CITLawI/R66)

Thefollowingcostscannotbecapitalizedasintangibleassets:

internallygeneratedgoodwill,coststodevelopcustomerlist,start-upcostsandtrainingcosts.

[SimilartoUSGAAP](CAS6.11)

Internallygeneratedgoodwillcannotbeamortized.(CITLaw12)

InvestmentProperty

Thereisnospecificdefinitionofinvestmentproperty;

suchpropertyisaccountedforasproperty,plantandequipmentunlessitmeetsthecriteriatobeclassifiedas“heldforsale”.

Investmentpropertyispropertyheldtoearnrentalincomeorforcapitalappreciation,orboth.

(CAS3.2)

Thisstandardshallapplytothefollowinginvestmentrealestates:

(1)Thelanduserightwhichhasalreadybeenrented;

(2)Thelanduserightwhichisheldandpreparedfortransferafterappreciation;

(3)Thebuildingswhichhavealreadybeenrented.

RentalincomeandcapitalappreciationaretaxableforCIT.

Investmentpropertyisrecognizedinitiallyatcost.

[SimilartoUSGAAP](CAS3.7)

Subsequenttoinitialrecognitionallinvestmentpropertyismeasuredusingthecostmodel.

Generallycostmodelshouldbeused.

Fairvaluemodelisalsopossiblewhenanactivemarketexistsandmarketpriceisavailable.

(CAS3.9)

Fortheinvestmentrealestatemeasuredthroughthefairvaluemodel,thereisnodepreciationoramortizationmadeforit.

Itsbookvalueshallbeadjustedonthebasisofitsfairvalueonthedateofthebalancesheet,andthedifferencebetweenthefairvalueanditsoriginalbookvalueshallbeincludedinthecurrentprofitsandlosses.

Therevaluationoftaxpositionofinvestmentpropertyisnotpermitted.

(CITLawI/R56)

Onlysalesordisposalgain(loss)istaxable(deductible)forCIT.

Investmentpropertyisaccountedforasproperty,plantandequipment,andtherearenotransferstoorfroman“investmentproperty”category.

Whereanenterprisewhichhaswell-establishedevidencetoindicatethatthepurposeoftheinvestmentpropertyhaschanged,itshallconverttheinvestmentpropertytootherassetsorviseversa.(CAS3.13)

Investmentpropertyistreatedinthesamewayas“property,plantandequipment”aswellas“landuseright”inPRCtax.

Inventory

Generallyinventoriesaremeasuredatthelowerofcostandmarket.

Theinventoriesshallbeinitiallymeasuredatcost.

(CAS1.5)

Whereanon-monetaryassetstransactionsatisfiesthefollowingconditionsatthesametime,thefairvalueoftheassetsreceivedandrelevanttaxesshallberegardedasthetransactioncost,andthedifferencebetweenthefairvalueoftheassetsreceivedandthecarryingvalueoftheassettransferredoutshallberecordedintotheprofitorlossofthecurrentperiod:

(1)Thetransactioniscommercialinnature;

and

(2)Thefairvalueoftheassetsreceivedortransferredoutcanbemeasuredreliably.

(CAS7.3)

1.Fortheinventoryacquiredbycashpayment,itspurchasepriceandtherelevanttaxesandexpensespaidshallbeusedasitscost;

2.Fortheinventoryacquiredthroughmeansotherthancashpayment,thefairvalueofsuchinventoryandtherelevanttaxesandexpensesshallbeusedascost.

(CITLawI/R72)

Costincludesalldirectexpendituretogetinventoryreadyforsale,includingattributableoverheads.

Thecostofinventoryconsistsofpurchasecosts,processingcostsandothercosts.(CAS1.5)

Othercostsofinventories"

referstothosecosts,otherthanpurchasecostsandprocessingcosts,happenedinbringingtheinventoriestotheirpresentlocationandcondition.(CAS1.8)

[Seeabove](CITLawI/R72)

“Market”iscurrentreplacementcostlimitedbynetrealisablevalue(ceiling)andnetrealisablevaluelessanormalprofitmargin(floor).

Netrealisablevalueistheestimatedsellingpriceles

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- 美国会计准则 中国会计准则 中国企业所得税简明对比表 英文版doc 美国 会计准则 中国 企业所得税 简明 对比 英文 doc

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

广东省普通高中学业水平考试数学科考试大纲Word文档下载推荐.docx

广东省普通高中学业水平考试数学科考试大纲Word文档下载推荐.docx