AssignmentWednesdayWord下载.docx

AssignmentWednesdayWord下载.docx

- 文档编号:20086604

- 上传时间:2023-01-16

- 格式:DOCX

- 页数:11

- 大小:116.45KB

AssignmentWednesdayWord下载.docx

《AssignmentWednesdayWord下载.docx》由会员分享,可在线阅读,更多相关《AssignmentWednesdayWord下载.docx(11页珍藏版)》请在冰豆网上搜索。

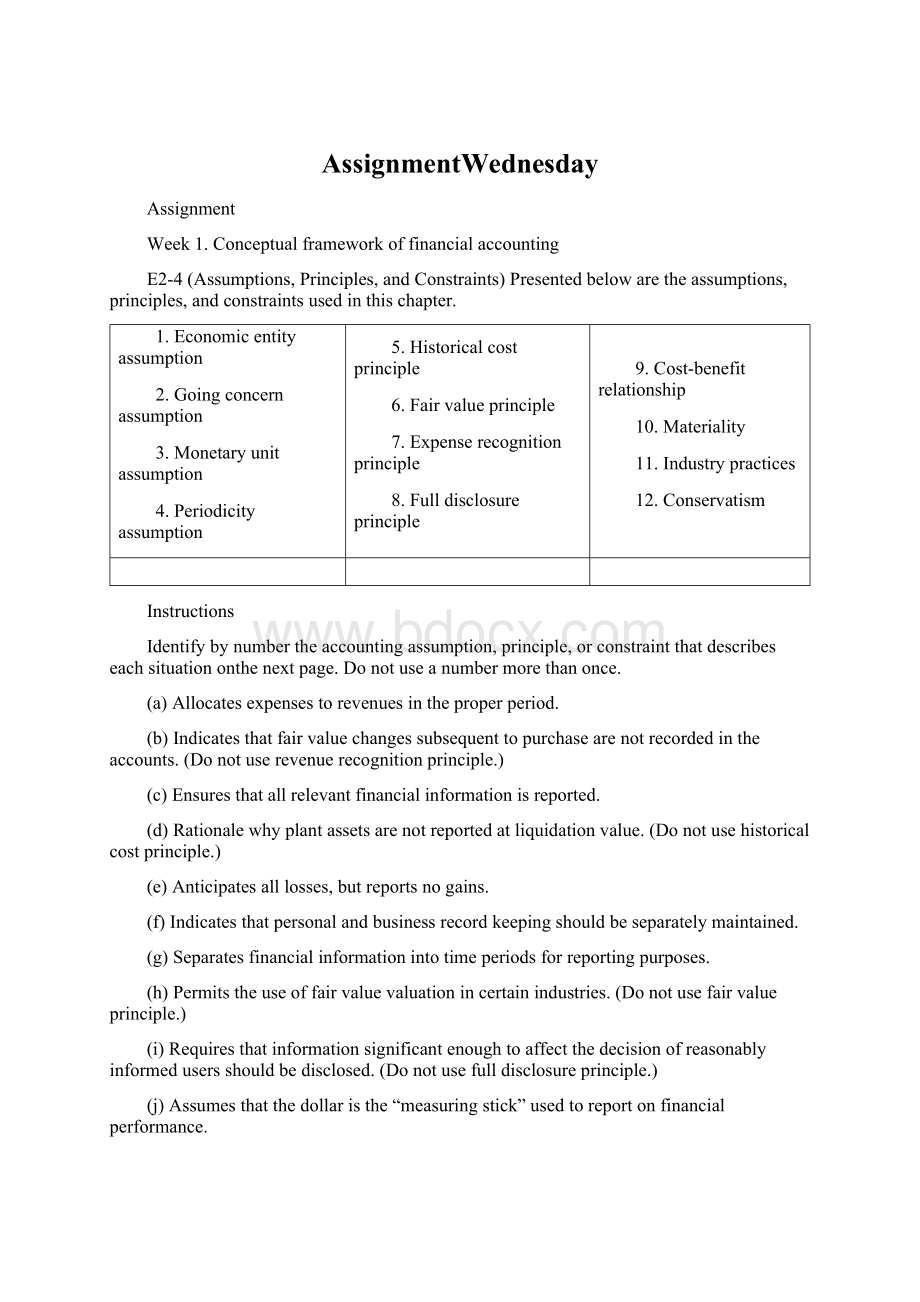

Instructions

Identifybynumbertheaccountingassumption,principle,orconstraintthatdescribeseachsituationonthenextpage.Donotuseanumbermorethanonce.

(a)Allocatesexpensestorevenuesintheproperperiod.

(b)Indicatesthatfairvaluechangessubsequenttopurchasearenotrecordedintheaccounts.(Donotuserevenuerecognitionprinciple.)

(c)Ensuresthatallrelevantfinancialinformationisreported.

(d)Rationalewhyplantassetsarenotreportedatliquidationvalue.(Donotusehistoricalcostprinciple.)

(e)Anticipatesalllosses,butreportsnogains.

(f)Indicatesthatpersonalandbusinessrecordkeepingshouldbeseparatelymaintained.

(g)Separatesfinancialinformationintotimeperiodsforreportingpurposes.

(h)Permitstheuseoffairvaluevaluationincertainindustries.(Donotusefairvalueprinciple.)

(i)Requiresthatinformationsignificantenoughtoaffectthedecisionofreasonablyinformedusersshouldbedisclosed.(Donotusefulldisclosureprinciple.)

(j)Assumesthatthedollaristhe“measuringstick”usedtoreportonfinancialperformance.

E3-6(AdjustingEntries)StephenKing,D.D.S.,openedadentalpracticeonJanuary1,2010.Duringthefirstmonthofoperationsthefollowingtransactionsoccurred.

1.Performedservicesforpatientswhohaddentalplaninsurance.AtJanuary31,$750ofsuchserviceswasearnedbutnotyetbilledtotheinsurancecompanies.

2.UtilityexpensesincurredbutnotpaidpriortoJanuary31totaled$520.

3.PurchaseddentalequipmentonJanuary1for$80,000,paying$20,000incashandsigninga$60,000,

3-yearnotepayable.Theequipmentdepreciates$400permonth.Interestis$500permonth.

4.Purchasedaone-yearmalpracticeinsurancepolicyonJanuary1for$15,000.

5.Purchased$1,600ofdentalsupplies.OnJanuary31,determinedthat$400ofsupplieswereonhand.

PreparetheadjustingentriesonJanuary31.(Omitexplanations.)Accounttitlesare:

AccumulatedDepreciation—DentalEquipment;

DepreciationExpense;

ServiceRevenue;

AccountsReceivable;

InsuranceExpense;

InterestExpense;

InterestPayable;

PrepaidInsurance;

Supplies;

SuppliesExpense;

UtilitiesExpense;

andUtilitiesPayable.

Week2-3Financialstatements

E4-4(Multiple-stepandSingle-step)TwoaccountantsforthefirmofAllenandWrightarearguingaboutthemeritsofpresentinganincomestatementinamultiple-stepversusasingle-stepformat.Thediscussioninvolvesthefollowing2010informationrelatedtoWebsterCompany($000omitted).

Administrativeexpense

Officers’salaries

Depreciationofofficefurnitureandequipment

Costofgoodssold

Rentalrevenue

Sellingexpense

Transportation-out

Salescommissions

Depreciationofsalesequipment

Sales

Incometax

Interestexpense

$4,900

3,960

63,570

17,230

2,690

7,980

6,480

96,500

7,580

1,860

(a)Prepareanincomestatementfortheyear2010usingthemultiple-stepform.Commonsharesoutstandingfor2010total40,550(000omitted).

(b)Prepareanincomestatementfortheyear2010usingthesingle-stepform.

(c)Whichonedoyouprefer?

Discuss.

P5-3(BalanceSheetAdjustmentandPreparation)TheadjustedtrialbalanceofEastwoodCompanyandotherrelatedinformationfortheyear2010arepresentedonthenextpage.

Additionalinformation:

1.TheLIFOmethodofinventoryvalueisused.

2.Thecostandfairvalueofthelong-terminvestmentsthatconsistofstocksandbondsisthesame.

3.TheamountoftheConstructionWorkinProgressaccountrepresentsthecostsexpendedtodateonabuildingintheprocessofconstruction.(Thecompanyrentsfactoryspaceatthepresenttime.)Thelandonwhichthebuildingisbeingconstructedcost$85,000,asshowninthetrialbalance.

4.Thepatentswerepurchasedbythecompanyatacostof$40,000andarebeingamortizedonastraight-linebasis.

5.Oftheunamortizeddiscountonbondspayable,$2,000willbeamortizedin2011.

6.Thenotespayablerepresentbankloansthataresecuredbylong-terminvestmentscarriedat$120,000.Thesebankloansareduein2011.

7.Thebondspayablebearinterestat8%payableeveryDecember31,andaredueJanuary1,2021.

8.600,000sharesofcommonstockofaparvalueof$1wereauthorized,ofwhich500,000shareswereissuedandoutstanding.

PrepareabalancesheetasofDecember31,2010,sothatallimportantinformationisfullydisclosed.

Week4Cashandreceivables

E7-5(RecordSalesGrossandNet)OnJune3,BoltonCompanysoldtoArquetteCompanymerchandisehavingasalepriceof$2,000withtermsof2/10,n/60,f.o.b.shippingpoint.Aninvoicetotaling$90,termsn/30,wasreceivedbyArquetteonJune8fromJohnBoothTransportServiceforthefreightcost.OnJune12,thecompanyreceivedacheckforthebalanceduefromArquetteCompany.

(a)PreparejournalentriesontheBoltonCompanybookstorecordalltheeventsnotedaboveundereachofthefollowingbases.

(1)Salesandreceivablesareenteredatgrosssellingprice.

(2)Salesandreceivablesareenteredatnetofcashdiscounts.

(b)Preparethejournalentryunderbasis2,assumingthatArquetteCompanydidnotremitpaymentuntilJuly29.

P7-2(Bad-DebtReporting)Presentedbelowareaseriesofunrelatedsituations.

1.HalenCompany’sunadjustedtrialbalanceatDecember31,2010,includedthefollowingaccounts.

Allowancefordoubtfulaccounts

Netsales

Debit

$4,000

Credit

$1,200,000

HalenCompanyestimatesitsbaddebtexpensetobe1.5%ofnetsales.Determineitsbaddebtexpensefor2010.

2.AnanalysisandagingofStuartCorp.accountsreceivableatDecember31,2010,disclosedthefollowing.

Amountsestimatedtobeuncollectible

Accountsreceivable

Allowancefordoubtfulaccounts(perbooks)

$180,000

1,750,000

125,000

WhatisthenetrealizablevalueofStuart’sreceivablesatDecember31,2010?

3.ShoreCo.providesfordoubtfulaccountsbasedon3%ofcreditsales.Thefollowingdataare

availablefor2010.

Creditsalesduring2010

Allowancefordoubtfulaccounts1/1/2010

Collectionofaccountswrittenoffinprioryears

(customercreditwasreestablished)

Customeraccountswrittenoffasuncollectibleduring2010

$2,400,000

17,000

8,000

30,000

WhatisthebalanceintheAllowanceforDoubtfulAccountsatDecember31,2010?

4.Attheendofitsfirstyearofoperations,December31,2010,DardenInc.reportedthefollowinginformation.

Accountsreceivable,netofallowancefordoubtfulaccounts

Baddebtexpensefor2010

$950,000

24,000

84,000

WhatshouldbethebalanceinaccountsreceivableatDecember31,2010,beforesubtractingthe

allowancefordoubtfulaccounts?

5.ThefollowingaccountsweretakenfromBullockInc.’strialbalanceatDecember31,2010.

Netcreditsales

$14,000

310,000

$750,000

Ifdoubtfulaccountsare3%ofaccountsreceivable,determinethebaddebtexpensetobereportedfor2010.

Answerthequestionsrelatingtoeachofthefiveindependentsituationsasrequested.

Week5-6Inventories

E8-17(FIFOandLIFO—PeriodicandPerpetual)ThefollowingisarecordofCannondaleCompany’stransactionsforBostonTeapotsforthemonthofMay2010.

(a)Assumingthatperpetualinventoriesarenotmaintainedandthataphysicalcountattheendofthemonthshows510unitsonhand,whatisthecostoftheendinginventoryusing

(1)FIFOand

(2)LIFO?

(b)Assumingthatperpetualrecordsaremaintainedandtheytieintothegeneralledger,calculatetheendinginventoryusing

(1)FIFOand

(2)LIFO.

E9-4(Lower-of-Cost-or-Market—JournalEntries)DoverCompanybeganoperationsin2010anddetermined

itsendinginventoryatcostandatlower-of-cost-or-marketatDecember31,2010,andDecember

31,2011.Thisinformationispresentedbelow.

12/31/10

12/31/11

Cost

$346,000

410,000

Lower-of-Cost-or-Market

$322,000

390,000

(a)PreparethejournalentriesrequiredatDecember31,2010,andDecember31,2011,assumingthattheinventoryisrecordedatlower-of-cost-or-market,andaperpetualinventorysystem(directmethod)isused.

(b)PreparejournalentriesrequiredatDecember31,2010,andDecember31,2011,assumingthattheinventoryisrecordedatcostandanallowanceaccountisadjustedateachyear-endunderaperpetualsystem.

(c)Whichofthetwomethodsaboveprovidesthehighernetincomeineachyear?

Week9-10Property,Plant,andEquipment

P10-8(NonmonetaryExchanges)HolyfieldCorporationwishestoexchangeamachineusedinitsoperations.Holyfieldhasreceivedthefollowingoffersfromothercompaniesintheindustry.

1.DorsettCompanyofferedtoexchangeasimilarmachineplus$23,000.(Theexchangehascommercialsubstanceforbothparties.)

2.WinstonCompanyofferedtoexchangeasimilarmachine.(Theexchangelackscommercialsubstanceforbothparties.)

3.ListonCompanyofferedtoexchangeasimilarmachine,butwanted$3,000inadditiontoHolyfield’smachine.(Theexchangehascommercialsubstanceforbothparties.)

Inaddition,Holyfiel

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- AssignmentWednesday

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

对中国城市家庭的教育投资行为的理论和实证研究.docx

对中国城市家庭的教育投资行为的理论和实证研究.docx