Ch 7 Exercise new with solutions文档格式.docx

Ch 7 Exercise new with solutions文档格式.docx

- 文档编号:18595187

- 上传时间:2022-12-29

- 格式:DOCX

- 页数:9

- 大小:417.45KB

Ch 7 Exercise new with solutions文档格式.docx

《Ch 7 Exercise new with solutions文档格式.docx》由会员分享,可在线阅读,更多相关《Ch 7 Exercise new with solutions文档格式.docx(9页珍藏版)》请在冰豆网上搜索。

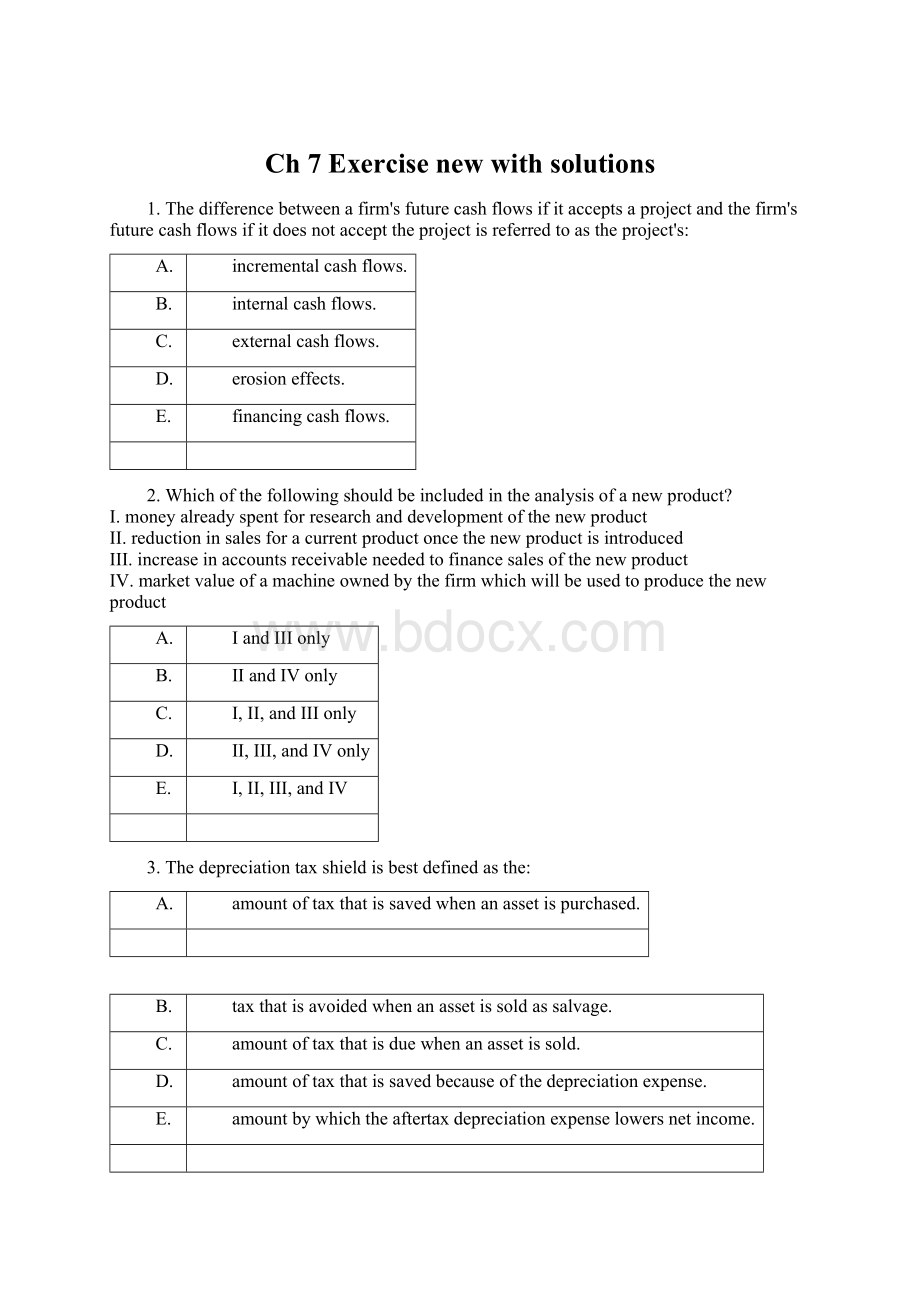

financingcashflows.

2.Whichofthefollowingshouldbeincludedintheanalysisofanewproduct?

I.moneyalreadyspentforresearchanddevelopmentofthenewproduct

II.reductioninsalesforacurrentproductoncethenewproductisintroduced

III.increaseinaccountsreceivableneededtofinancesalesofthenewproduct

IV.marketvalueofamachineownedbythefirmwhichwillbeusedtoproducethenewproduct

IandIIIonly

IIandIVonly

I,II,andIIIonly

II,III,andIVonly

I,II,III,andIV

3.Thedepreciationtaxshieldisbestdefinedasthe:

amountoftaxthatissavedwhenanassetispurchased.

taxthatisavoidedwhenanassetissoldassalvage.

amountoftaxthatisduewhenanassetissold.

amountoftaxthatissavedbecauseofthedepreciationexpense.

amountbywhichtheaftertaxdepreciationexpenselowersnetincome.

4.Allofthefollowingarerelatedtoaproposedproject.Whichoftheseshouldbeincludedinthecashflowattimezero?

I.purchaseof$1,400ofpartsinventoryneededtosupporttheproject

II.loanof$125,000usedtofinancetheproject

III.depreciationtaxshieldof$1,100

IV.$6,500ofequipmentneededtocommencetheproject

IandIIonly

IandIVonly

I,II,andIVonly

5.Youareconsideringthepurchaseofanewmachine.Youranalysisincludestheevaluationoftwomachineswhichhavedifferinginitialandongoingcostsanddifferinglives.Whichevermachineispurchasedwillbereplacedattheendofitsusefullife.Youshouldselectthemachinewhichhasthe:

longestlife.

highestannualoperatingcost.

lowestannualoperatingcost.

highestequivalentannualcost.

lowestequivalentannualcost.

6.Changesinthenetworkingcapitalrequirements:

canaffectthecashflowsofaprojecteveryyearoftheproject'

slife.

onlyaffecttheinitialcashflowsofaproject.

onlyaffectthecashflowattimezeroandthefinalyearofaproject.

aregenerallyexcludedfromprojectanalysisduetotheirirrelevancetothetotalproject.

reflectonlythechangesinthecurrentassetaccounts.

7.Whichoneofthefollowingisacorrectmethodforcomputingtheoperatingcashflowofaprojectassumingthattheinterestexpenseisequaltozero?

EBIT+D

EBIT-T

NI+D

(Sales-Costs)×

(1-D)×

(1-T)

(1-T)

8.Jefferson&

Sonsisevaluatingaprojectthatwillincreaseannualsalesby$145,000andannualcashcostsby$94,000.Theprojectwillinitiallyrequire$110,000infixedassetsthatwillbedepreciatedstraight-linetoazerobookvalueoverthe4-yearlifeoftheproject.Theapplicabletaxrateis32percent.Whatistheoperatingcashflowforthisproject?

$11,220

$29,920

$43,480

$46,480

$46,620

OCF=($145,000-$94,000)(1-0.32)+($110,000/4)(0.32)=$43,480

9.TheLumberYardisconsideringaddinganewproductlinethatisexpectedtoincreaseannualsalesby$238,000andcashexpensesby$184,000.Theinitialinvestmentwillrequire$96,000infixedassetsthatwillbedepreciatedusingthestraight-linemethodtoazerobookvalueoverthe6-yearlifeoftheproject.Thecompanyhasamarginaltaxrateof32percent.Whatistheannualvalueofthedepreciationtaxshield?

$5,120

$13,160

$25,840

$32,560

$41,840

Depreciationtaxshield=($96,000/6)×

0.32=$5,120

10.PrecisionToolisanalyzingtwomachinestodeterminewhichoneitshouldpurchase.Thecompanyrequiresa15percentrateofreturnandusesstraight-linedepreciationtoazerobookvalueoverthelifeofitsequipment.MachineAhasacostof$892,000,annualoperatingcostsof$28,200,anda4-yearlife.MachineBcosts$1,118,000,hasannualoperatingcostsof$19,500,andhasa5-yearlife.Whichevermachineispurchasedwillbereplacedattheendofitsusefullife.PrecisionToolshouldpurchaseMachine_____becauseitlowersthefirm'

sannualcostbyapproximately_______ascomparedtotheothermachine.

A;

$12,380

$17,404

B;

$16,965

$17,521

Differenceincosts=-$340,636.69-(-$353,016.79)=$12,380.09

11.TheBuckStoreisconsideringaprojectthatwillrequireadditionalinventoryof$216,000andwillincreaseaccountspayableby$181,000.Accountsreceivablearecurrently$525,000andareexpectedtoincreaseby9percentifthisprojectisaccepted.Whatistheproject'

sinitialcashflowfornetworkingcapital?

-$82,250

-$12,250

$12,250

$36,250

$44,250

NWCrequirement=-$216,000+$181,000-($525,000×

0.09)=-$82,250

12.Cantheinitialcashflowattimezeroforaprojecteverbeapositivevalue?

Ifyes,giveanexample.Ifno,explainwhynot.

Theinitialcashflowcanbeapositivevalue.Forexample,ifaprojectreducednetworkingcapitalbyanamountthatexceededtheinitialcostforfixedassets,theinitialcashflowwouldbeapositiveamount.

13.Whatistheformulaforthetax-shieldapproachtoOCF?

Explainthetwokeypointstheformulaillustrates.

OCF=(Sales-Costs)×

(1-T)+Depreciation×

T

TheformulaillustratesthatcashincomeandexpensesaffectOCFonanaftertaxbasis.Theformulaalsoillustratesthateventhoughdepreciationisanon-cashexpenseitdoesaffectOCFbecauseofthetaxsavingsrealizedfromthedepreciationexpense.

14.Whatistheprimarypurposeofcomputingtheequivalentannualcostswhencomparingtwomachines?

Whatistheassumptionthatisbeingmadeabouteachmachine?

Theprimarypurposeistocomputetheannualcostofeachmachineonacomparablebasissothattheleastexpensivemachinecanbeidentifiedgiventhatthemachinesgenerallyhavedifferinglivesandcosts.Theassumptionisthatwhichevermachineisacquired,itwillbereplacedattheendofitsusefullife.

independent.

interdependent.

mutuallyexclusive.

economicallyscaled.

operationallydistinct.

15.IfafirmacceptsProjectAitwillnotbefeasibletoalsoacceptProjectBbecausebothprojectswouldrequirethesimultaneousandexclusiveuseofthesamepieceofmachinery.Theseprojectsareconsideredtobe:

16.Whichoneofthefollowingmethodsdeterminestheamountofthechangeaproposedprojectwillhaveonthevalueofafirm?

netpresentvalue

discountedpayback

internalrateofreturn

profitabilityindex

payback

17.Ifaprojecthasanetpresentvalueequaltozero,then:

thetotalofthecashinflowsmustequaltheinitialcostoftheproject.

theprojectearnsareturnexactlyequaltothediscountrate.

adecreaseintheproject'

sinitialcostwillcausetheprojecttohaveanegativeNPV.

anydelayinreceivingtheprojectedcashinflowswillcausetheprojecttohaveapositiveNPV.

theproject'

sPImustbealsobeequaltozero.

18.Whyispaybackoftenusedasthesolemethodofanalyzingaproposedsmallproject?

Paybackconsidersthetimevalueofmoney.

Allrelevantcashflowsareincludedinthepaybackanalysis.

Itistheonlymethodwherethebenefitsoftheanalysisoutweighthecostsofthatanalysis.

Paybackisthemostdesirableofthevariousfinancialmethodsofanalysis.

Paybackisfocusedonthelong-termimpactofaproject.

19.Whichofthefollowingareconsideredweaknessesintheaverageaccountingreturnmethodofprojectanalysis?

I.exclusionoftimevalueofmoneyconsiderations

II.needofacutoffrate

III.easilyobtainableinformationforcomputation

IV.basedonaccountingvalues

Ionly

IIandIIIonly

20.Whichoneofthefollowingstatementsrelatedtotheinternalrateofreturn(IRR)iscorrect?

TheIRRyieldsthesameacceptandrejectdecisionsasthenetpresentvaluemethodgivenmutuallyexclusiveprojects.

AprojectwithanIRRequaltotherequiredreturnwouldreducethevalueofafirmifaccepted.

TheIRRisequaltotherequiredreturnwhenthenetpresentvalueisequaltozero.

FinancingtypeprojectsshouldbeacceptediftheIRRexceedstherequiredreturn.

TheaverageaccountingreturnisabettermethodofanalysisthantheIRRfromafinancialpointofview.

21.DouglassInteriorsisconsideringtwomutuallyexclusiveprojectsandhavedeterminedthatthecrossoverratefortheseprojectsis11.7percent.ProjectAhasaninternalrateofreturn(IRR)of15.3percentandProjectBhasanIRRof16.5percent.Giventhisinformation,whichoneofthefollowingstatementsiscorrect?

ProjectAshouldbeacceptedasitsIRRisclosertothecrossoverpointthanisProjectB'

sIRR.

ProjectBshouldbeacceptedasithasthehigherIRR.

Bothprojectsshouldbeacceptedasbothoftheproject'

sIRRsexceedthecrossoverrate.

Neitherprojectshouldbeacceptedsincebothoftheproject'

Youcannotdeterminewhichprojectshouldbeacceptedgiventheinformationprovided.

22.Whichoneofthefollowingmethodsofanalysisprovidesthebestinformationonthecost-benefitaspectsofaproject?

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- Ch Exercise new with solutions

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

对中国城市家庭的教育投资行为的理论和实证研究.docx

对中国城市家庭的教育投资行为的理论和实证研究.docx