Chapter 5 recommended end of chapter problems.docx

Chapter 5 recommended end of chapter problems.docx

- 文档编号:11725667

- 上传时间:2023-03-31

- 格式:DOCX

- 页数:27

- 大小:203.79KB

Chapter 5 recommended end of chapter problems.docx

《Chapter 5 recommended end of chapter problems.docx》由会员分享,可在线阅读,更多相关《Chapter 5 recommended end of chapter problems.docx(27页珍藏版)》请在冰豆网上搜索。

Chapter5recommendedendofchapterproblems

Ch5Recommendedend-of-chapterproblems

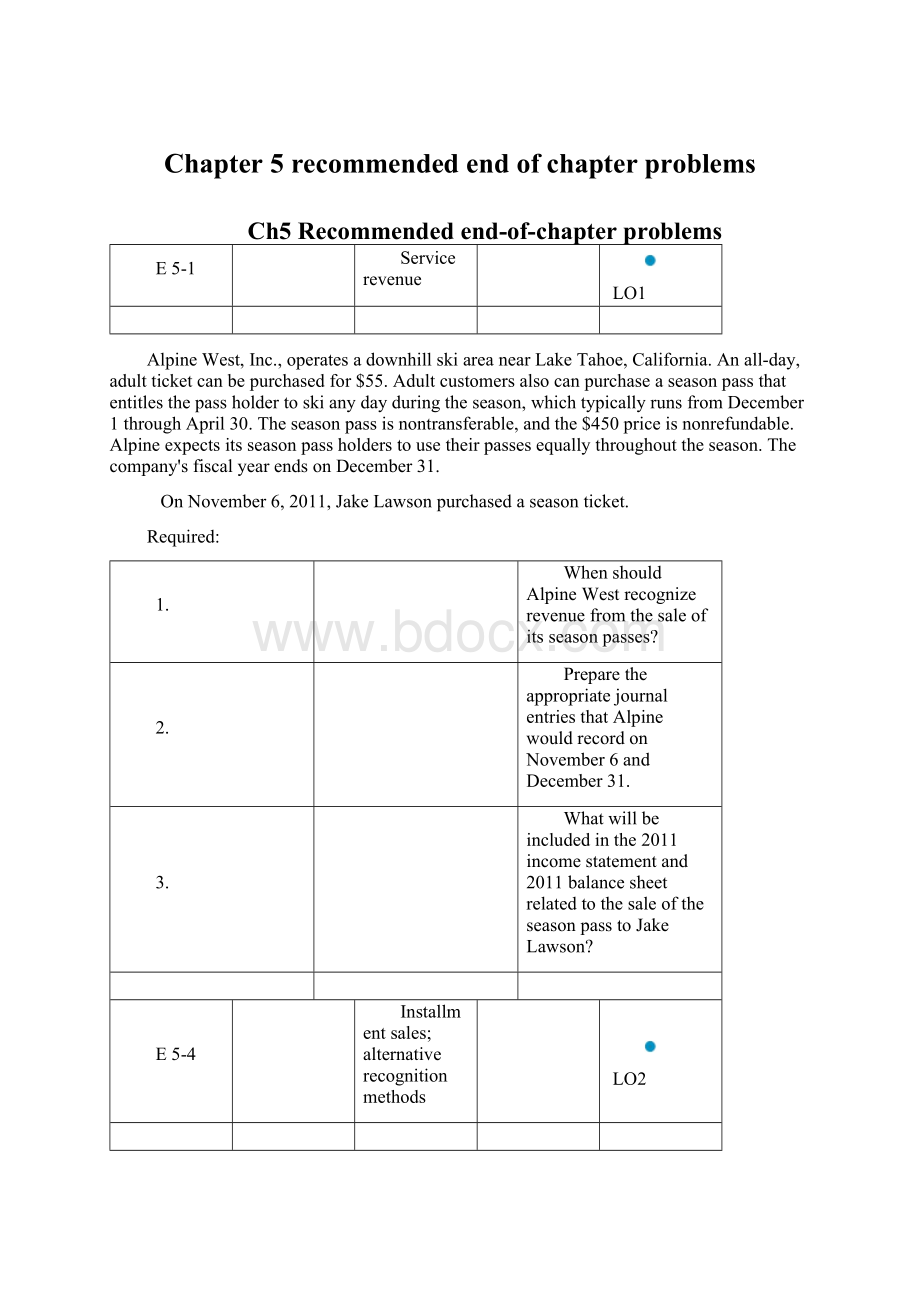

E5-1

Servicerevenue

LO1

AlpineWest,Inc.,operatesadownhillskiareanearLakeTahoe,California.Anall-day,adultticketcanbepurchasedfor$55.Adultcustomersalsocanpurchaseaseasonpassthatentitlesthepassholdertoskianydayduringtheseason,whichtypicallyrunsfromDecember1throughApril30.Theseasonpassisnontransferable,andthe$450priceisnonrefundable.Alpineexpectsitsseasonpassholderstousetheirpassesequallythroughouttheseason.Thecompany'sfiscalyearendsonDecember31.

OnNovember6,2011,JakeLawsonpurchasedaseasonticket.

Required:

1.

WhenshouldAlpineWestrecognizerevenuefromthesaleofitsseasonpasses?

2.

PreparetheappropriatejournalentriesthatAlpinewouldrecordonNovember6andDecember31.

3.

Whatwillbeincludedinthe2011incomestatementand2011balancesheetrelatedtothesaleoftheseasonpasstoJakeLawson?

E5-4

Installmentsales;alternativerecognitionmethods

LO2

OnJuly1,2011,theFosterCompanysoldinventorytotheSlateCorporationfor$300,000.Termsofthesalecalledforadownpaymentof$75,000andthreeannualinstallmentsof$75,000dueoneachJuly1,beginningJuly1,2012.Eachinstallmentalsowillincludeinterestontheunpaidbalanceapplyinganappropriateinterestrate.TheinventorycostFoster$120,000.Thecompanyusestheperpetualinventorysystem.

Required:

1.

Computetheamountofgrossprofittoberecognizedfromtheinstallmentsalein2011,2012,2013,and2014usingpointofdeliveryrevenuerecognition.Ignoreinterestcharges.

2.

Repeatrequirement1applyingtheinstallmentsalesmethod.

3.

Repeatrequirement1applyingthecostrecoverymethod.

E5-6

Installmentsalesandcostrecoverymethods;solveforunknowns

LO2

WolfComputerCompanybeganoperationsin2011.Thecompanyallowscustomerstopayininstallmentsformanyofitsproducts.Installmentsalesfor2011were$1,000,000.Ifrevenueisrecognizedatthepointofdelivery,$600,000ingrossprofitwouldberecognizedin2011.Ifthecompanyinsteadusesthecostrecoverymethod,$100,000ingrossprofitwouldberecognizedin2011.

Required:

1.

Whatwastheamountofcashcollectedoninstallmentsalesin2011?

2.

Whatamountofgrossprofitwouldberecognizedifthecompanyusestheinstallmentsalesmethod?

E5-11

Percentage-of-completionmethod;lossprojectedonentireproject

LO4

OnFebruary1,2011,ArrowConstructionCompanyenteredintoathree-yearconstructioncontracttobuildabridgeforapriceof$8,000,000.During2011,costsof$2,000,000wereincurredwithestimatedcostsof$4,000,000yettobeincurred.Billingsof$2,500,000weresentandcashcollectedwas$2,250,000.

In2012,costsincurredwere$2,500,000withremainingcostsestimatedtobe$3,600,000.2012billingswere$2,750,000and$2,475,000cashwascollected.Theprojectwascompletedin2013afteradditionalcostsof$3,800,000wereincurred.Thecompany'sfiscalyear-endisDecember31.Arrowusesthepercentage-of-completionmethod.

Required:

1.

Calculatetheamountofgrossprofitorlosstoberecognizedineachofthethreeyears.

2.

Preparejournalentriesfor2011and2012torecordthetransactionsdescribed(creditvariousaccountsforconstructioncostsincurred).

3.

PrepareapartialbalancesheettoshowthepresentationoftheprojectasofDecember31,2011and2012.

E5-12

Completedcontractmethod;lossprojectedonentireproject

LO4

[ThisisavariationofExercise5-11focusingonthecompletedcontractmethod.]

OnFebruary1,2011,ArrowConstructionCompanyenteredintoathree-yearconstructioncontracttobuildabridgeforapriceof$8,000,000.During2011,costsof$2,000,000wereincurredwithestimatedcostsof$4,000,000yettobeincurred.Billingsof$2,500,000weresentandcashcollectedwas$2,250,000.

p.278

In2012,costsincurredwere$2,500,000withremainingcostsestimatedtobe$3,600,000.2012billingswere$2,750,000and$2,475,000cashwascollected.Theprojectwascompletedin2013afteradditionalcostsof$3,800,000wereincurred.Thecompany'sfiscalyear-endisDecember31.Arrowusesthecompletedcontractmethod.

Required:

1.

Calculatetheamountofgrossprofitorlosstoberecognizedineachofthethreeyears.

2.

Preparejournalentriesfor2011and2012torecordthetransactionsdescribed(creditvariousaccountsforconstructioncostsincurred).

3.

PrepareapartialbalancesheettoshowthepresentationoftheprojectasofDecember31,2011and2012.

E5-13

Income(loss)recognition;percentage-of-completionandcompletedcontractmethodscompared

LO4

BradyConstructionCompanycontractedtobuildanapartmentcomplexforapriceof$5,000,000.Constructionbeganin2011andwascompletedin2013.Thefollowingareaseriesofindependentsituations,numbered1through6,involvingdifferingcostsfortheproject.Allcostsarestatedinthousandsofdollars.

Required:

Copyandcompletethefollowingtable.

Problem:

P5-4

Installmentsalesandcostrecoverymethods

LO2

MulcaheyBuilders(MB)remodelsofficebuildingsinlow-incomeurbanareasthatareundergoingeconomicrevitalization.MBtypicallyacceptsa25%downpaymentwhentheycompleteajobandanotewhichrequiresthattheremainderbepaidinthreeequalinstallmentsoverthenextthreeyears,plusinterest.Becauseoftheinherentuncertaintyassociatedwithreceivingthesepayments,MBhashistoricallyusedthecostrecoverymethodtorecognizerevenue.

AsofJanuary1,2011,MB'soutstandinggrossinstallmentaccountsreceivable(notnetofdeferredgrossprofit)consistofthefollowing:

1.

$400,000duefromtheBluebirdMotel.MBcompletedtheBluebirdjobin2009,andestimatedgrossprofitonthatjobis25%.

2.

$150,000duefromthePitStopGasandMiniMart.MBcompletedthePitStopjobin2008,andestimatedgrossprofitonthatjobis35%.

DanMulcaheyhasbeenconsideringswitchingfromthecostrecoverymethodtotheinstallmentsalesmethod,becausehewantstoshowthehighestpossiblegrossprofitin2011andheunderstandsthattheinstallmentsalesmethodrecognizesgrossprofitsoonerthandoesthecostrecoverymethod.

Required:

1.

Calculatehowmuchgrossprofitisexpectedtobeearnedonthesejobsin2011underthecostrecoverymethod,andhowmuchwouldbeearnedifMBinsteadusedtheinstallmentsalesmethod.Ignoreinterest.

2.

IfDanisprimarilyconcernedabout2011,doyouthinkhewouldbehappywithaswitchtotheinstallmentsalesmethod?

Explain.

P5-5

Percentage-of-completionmethod

LO4

In2011,theWestgateConstructionCompanyenteredintoacontracttoconstructaroadforSantaClaraCountyfor$10,000,000.Theroadwascompletedin2013.Informationrelatedtothecontractisasfollows:

Westgateusesthepercentage-of-completionmethodofaccountingforlong-termconstructioncontracts.

Required:

1.

Calculatetheamountofgrossprofittoberecognizedineachofthethreeyears.

2.

Prepareallnecessaryjournalentriesforeachoftheyears(creditvariousaccountsforconstructioncostsincurred).

3.

Prepareapartialbalancesheetfor2011and2012showinganyitemsrelatedtothecontract.

4.

Calculatetheamountofgrossprofittoberecognizedineachofthethreeyearsassumingthefollowingcostsincurredandcoststocompleteinformation:

p.286

5.

Calculatetheamountofgrossprofittoberecognizedineachofthethreeyearsassumingthefollowingcostsincurredandcoststocompleteinformation:

P5-6

Completedcontractmethod

LO4

[ThisisavariationofProblem5-5modifiedtofocusonthecompletedcontractmethod.]

Required:

CompletetherequirementsofProblem5-5assumingthatWestgateConstructionusesthecompletedcontractmethod.

P5-8

Constructionaccounting;lossprojectedonentireproject

LO4

CurtissConstructionCompany,Inc.,enteredintoafixed-pricecontractwithAxelrodAssociatesonJuly1,2011,toconstructafour-storyofficebuilding.Atthattime,Curtissestimatedthatitwouldtakebetweentwoandthreeyearstocompletetheproject.Thetotalcontractpriceforconstructionofthebuildingis$4,000,000.Curtissappropriatelyaccountsforthiscontractunderthecompletedcontractmethodinitsfinancialstatements.ThebuildingwascompletedonDecember31,2013.Estimatedpercentageofcompletion,accumulatedcontractcostsincurred,estimatedcoststocompletethecontract,andaccumulatedbillingstoAxelrodunderthecontractwereasfollows:

Required:

1.

Prepareschedulestocomputegrossprofitorlosstoberecognizedasaresultofthiscontractforeachofthethreeyears.

2.

AssumingCurtissusesthepercentage-of-completionmethodofaccountingforlong-termconstructioncontracts,computegrossprofitorlosstoberecognizedineachofthethreeyears.

3.

Assumingthepercentage-of-completionmethod,computetheamounttobeshowninthebalancesheetattheendof2011and2012aseithercostinexcessofbillingsorbillingsinexcessofcosts.

CPAExamQuestions

ThefollowingquestionsareusedintheKaplanCPAReviewCoursetostudyrevenuerecognitionwhilepreparingfortheCPAexamination.Determinetheresponsethatbestcompletesthestatementsorquestions.

1.

OnOctob

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- Chapter recommended end of problems

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

链接地址:https://www.bdocx.com/doc/11725667.html

《雷雨》中的蘩漪人物形象分析 1.docx

《雷雨》中的蘩漪人物形象分析 1.docx