财务会计会计英语复习练习题.docx

财务会计会计英语复习练习题.docx

- 文档编号:11021159

- 上传时间:2023-02-24

- 格式:DOCX

- 页数:25

- 大小:35.46KB

财务会计会计英语复习练习题.docx

《财务会计会计英语复习练习题.docx》由会员分享,可在线阅读,更多相关《财务会计会计英语复习练习题.docx(25页珍藏版)》请在冰豆网上搜索。

财务会计会计英语复习练习题

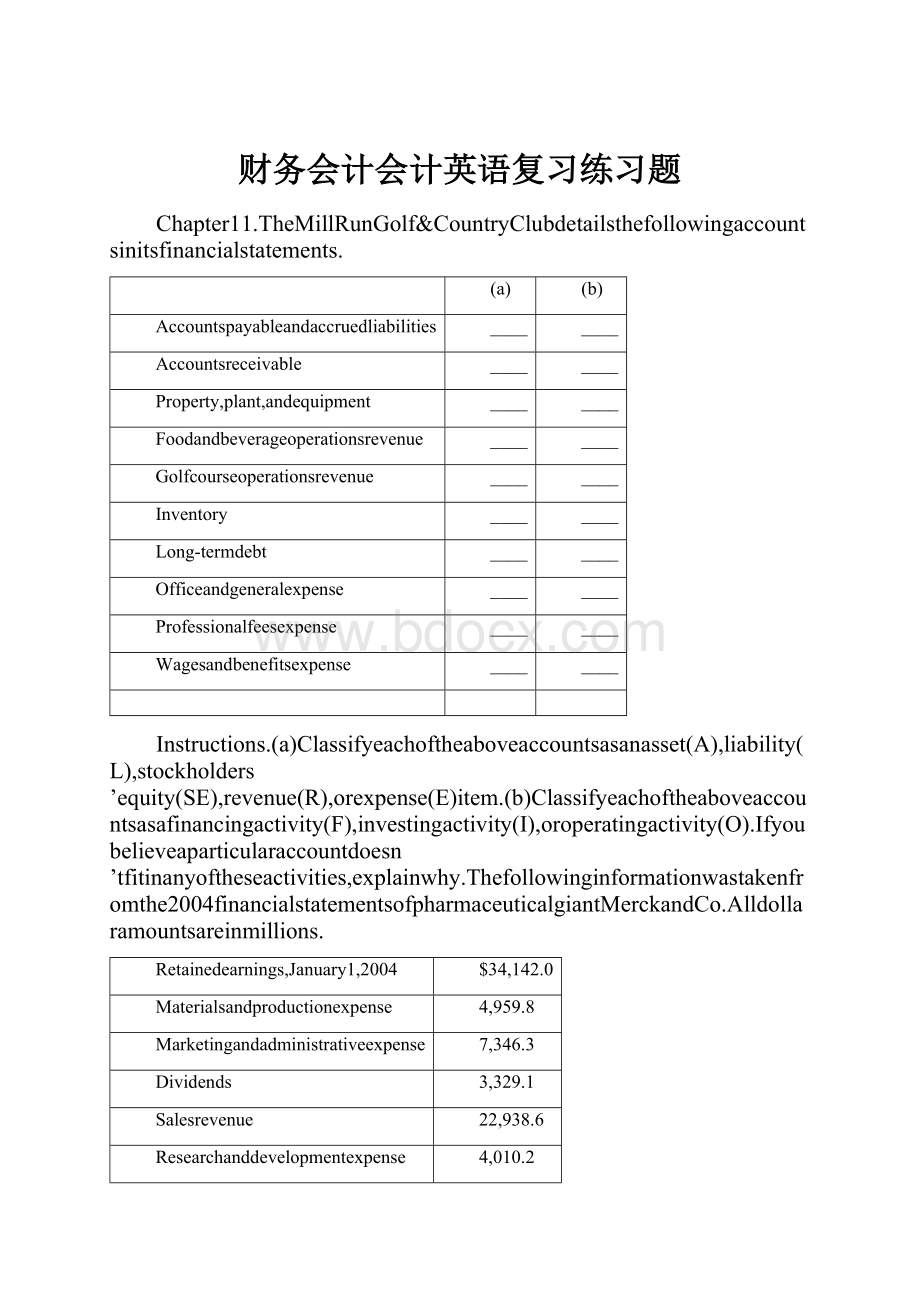

Chapter11.TheMillRunGolf&CountryClubdetailsthefollowingaccountsinitsfinancialstatements.

(a)

(b)

Accountspayableandaccruedliabilities

____

____

Accountsreceivable

____

____

Property,plant,andequipment

____

____

Foodandbeverageoperationsrevenue

____

____

Golfcourseoperationsrevenue

____

____

Inventory

____

____

Long-termdebt

____

____

Officeandgeneralexpense

____

____

Professionalfeesexpense

____

____

Wagesandbenefitsexpense

____

____

Instructions.(a)Classifyeachoftheaboveaccountsasanasset(A),liability(L),stockholders’equity(SE),revenue(R),orexpense(E)item.(b)Classifyeachoftheaboveaccountsasafinancingactivity(F),investingactivity(I),oroperatingactivity(O).Ifyoubelieveaparticularaccountdoesn’tfitinanyoftheseactivities,explainwhy.Thefollowinginformationwastakenfromthe2004financialstatementsofpharmaceuticalgiantMerckandCo.Alldollaramountsareinmillions.

Retainedearnings,January1,2004

$34,142.0

Materialsandproductionexpense

4,959.8

Marketingandadministrativeexpense

7,346.3

Dividends

3,329.1

Salesrevenue

22,938.6

Researchanddevelopmentexpense

4,010.2

Taxexpense

2.161.1

Otherrevenue

1,352.2

Instructions.Afteranalyzingthedata,prepareanincomestatementandaretainedearningsstatementfortheyearendingDecember31,2004.SupposethatMerckdecidedtoreduceitsresearchanddevelopmentexpenseby50%.Whatwouldbetheshort-termimplications?

Whatwouldbethelong-termimplications?

Howdoyouthinkthestockmarketwouldreact?

3.KelloggCompanyistheworld’sleadingproducerofready-to-eatcerealandaleadingproducerofgrain-basedconveniencefoodssuchasfrozenwafflesandcerealbars.Thefollowingitemsweretakenfromits2004incomestatementandbalancesheet.Alldollarsareinmillions.

_____Retainedearnings

$2,701.3

_____Long-termdebt

$3,892.6

_____Costofgoodssold

5,298.7

_____Inventories

681.0

_____Sellingandadministrativeexpense

2,634.1

_____Netsales

9,613.9

_____Cash

417.4

_____Accountspayable

767.2

_____Notespayable

709.7

_____Commonstock

103.8

_____Interestexpense

308.6

_____Incometaxexpense

475.3

_____Otherexpense

6.6

Instructions.Performeachofthefollowing.(a)Ineachcaseidentifywhethertheitemisanasset(A),liability(L),stockholders’equity(SE),revenue(R),orexpense(E).PrepareanincomestatementforKelloggCompanyfortheyearendedDecember31,2004.ThefollowingitemsweretakenfromthebalancesheetofNike,Inc.

(1)Cash

$828.0

(7)Inventories

$1,633.6

(2)Accountsreceivable

2,120.2

(8)Incometaxespayable

118.2

(3)Commonstock

890.6

(9)Property,plant,andequipment

1,586.9

(4)Notespayable

146.0

(10)Retainedearnings

3,891.1

(5)Otherassets

1,722.9

(11)Accountspayable

763.8

(6)Otherliabilities

2,081.9

Instructions.Performeachofthefollowing.(a)Classifyeachoftheseitemsasanasset,liability,orstockholders’equity.(Alldollarsareinmillions.)DetermineNike’saccountingequationbycalculatingthevalueoftotalassets,totalliabilities,andtotalstockholders’equity.TowhatextentdoseNikerelyondebtversusequityfinancing?

Chapter2.1.TheseitemsaretakenfromthefinancialstatementsofDonovanCo.atDecember31.2007

Building

$105,800

Accountsreceivable

12,600

Prepaidinsurance

4,680

Cash

16,840

Equipment

82,400

Land

61,200

Insuranceexpense

780

Depreciationexpense

5,300

Interestexpense

2,600

Commonstock

62,000

Retainedearnings(January1,2007)

40,000

Accumulateddepreciation-building

45,600

Accountspayable

9,500

Mortgagepayable

93,600

Accumulateddepreciation-equipment

18,720

Interestpayable

3,600

Bowlingrevenues

19,180

Instructions.Prepareaclassifiedbalancesheet.Assumethat$13,600ofthemortgagepayablewillbepaidin2008.Thefollowingitemsweretakenfromthe2004financialstatementsofTexasInstruments,Inc.(Alldollarsareinmillions.)

Long-termdebt

$368

Cash

$2,668

Commonstock

2,488

Accumulateddepreciation

5,655

Prepaidexpense

326

Accountspayable

1,444

Property,plant,andequipment

9,573

Othernoncurrentassets

1,927

Othercurrentassets

554

Othernoncurrentliabilities

943

Othercurrentliabilities

470

Retainedearnings

10,575

Long-terminvestments

264

Accountsreceivable

1,696

Short-terminvestments

3,690

Inventories

1,256

Loanspayablein2005

11

Instructions.PrepareaclassifiedbalancesheetingoodformasofDecember31,2004.3.ThesefinancialstatementitemsareforSnyderCorporationatyear-end,July31,2007.

Salariespayable

$2,080

Salariesexpense

51,700

Utilitiesexpense

22,600

Equipment

18,500

Accountspayable

4,100

Commissionrevenue

61,100

Rentrevenue

8,500

Long-termnotepayable

1,800

Commonstock

16,000

Cash

24,200

Accountsreceivable

9,780

Accumulateddepreciation

6,000

Dividends

4,000

Depreciationexpense

4,000

Retainedearnings(beginningoftheyear)

35,200

Instructions.Prepareanincomestatementandaretainedearningsstatementfortheyear.SnyderCorporationdidnotissueanynewstockduringtheyear.PrepareaclassifiedbalancesheetatJuly31.Computethecurrentratioanddebttototalassetsratio.SupposethatyouarethepresidentofAlliedEquipment.Yoursalesmanagerhasapproachedyouwithaproposaltosell$20,000ofequipmenttoSnyder.HewouldliketoprovidealoantoSnyderintheformofa10%,5-yearnotepayable.EvaluatehowthisloanwouldchangeSnyder’scurrentratioanddebttototalassetsratio,anddiscusswhetheryouwouldmakethesale.Thechieffinancialofficer(CFO)ofSuperCleanCorporationrequestedthattheaccountingdepartmentprepareapreliminarybalancesheetonDecember30,007,sothattheCFOcouldgetanideaofhowthecompanystood.Heknowsthatcertaindebtagreementswithitscreditorsrequirethecompanytomaintainacurrentratioofatleast2:

1.Thepreliminarybalancesheetisasfollows.

SUPERCLEAN

CORP.

BalanceSheet

December30,2007

Currentassets

Currentliabilities

Cash

$30,000

Accountspayable

$25,000

Accountsreceivable20,000

Salariespayable

15,000

$40,000

Prepaidinsurance

10,000

$60,000

Long-termliabilities

Notespayable

80,000

Totalliabilities

120,000

Property,plant,andequipment(net)200,000

Stockholders’equity

Totalassets

$260,000

Commonstock

100,000

Retainedearnings

40,000

140,000

Totalliabilitiesandstockholdersequity$260,000

5.Instructions.Calculatethecurrentratioandworkingcapitalbasedonthepreliminarybalancesheet.Basedontheresultsin(a),theCFOrequestedthat$25,000ofcashbeusedtopayoffthebalanceoftheaccountspayableaccountonDecember31,2007.Calculatethenewcurrentratioandworkingcapitalafterthecompanytakestheseactions.Discusstheprosandconsofthecurrentratioandworkingcapitalasmeasuresofliquidity.WasitunethicalfortheCFOtotakethesesteps?

Thefollowingdataweretakenfromthe2004and2003financialstatementsofAmericanEagleOutfitters.(Alldollarsareinthousands.)

2004

2003

Currentassets

$525,623

$427,878

Totalassets

865,071

741,339

Currentliabilities

189,035

141,586

Totalliabilities

221,401

163,857

Totalstockholders’equity

643,670

577,482

Cashprovidedbyoperatingactivities

189,469

104,548

Capitalexpenditures

64,173

61,407

Dividendspaid

-0-

-0-

Instructions.Performeachofthefollowing.Calculatethedebttototalassetsratioforeachyear.Calculatethefreecashflowforeachyear.DiscussAmericanEagle’ssolvencyin2004versus2003.DiscussAmericanEagle’sabilitytofinanceitsinvestmentactivitieswithcashprovidedbyoperatingactivities,andhowanydeficiencywouldbemet.

Chapter3.1.During2007,itsfirstyearofoperationsasadeliveryservice,ChengCorp.enteredintothefollowingtransactions.

Issuedsharesofcommonstocktoinvestorsinexchangefor$110,000incash.Borrowed$45,000byissuingbonds.Purchaseddeliverytrucksfor$60,000cash.Received$16,000fromcustomersforservicesprovided.Purchasedsuppliesfor$4,200onaccount.Paidrentof$5,600.Performedservicesonaccountfor$8,000.Paidsalariesof$28,000.Paidadividendof$11,000toshareholders.

InstructionsUsingthefollowingtabularanalysis,showtheeffectofeachtransactionontheaccountingequation.PutexplanationsforchangestoStockholders’Equityintheright-handmargin.

Assets=Liabilities+Stockholders’EquityCash+Accounts+Supplies+Property,Plant,=Accounts+Bonds+Common+RetainedReceivableandEquipmentPayablePayableStockEarnings

2.SelectedtransactionsforWelcomeHome,aninteriordecoratorcorporation,initsfirst

monthofbusiness,areasfollows.Issuedstocktoinvestorsfor$12,000incash.Purchasedusedcarfor$8,000cashforuseinbusiness.Purchasedsuppliesonaccountfor$300.Billedcustomers$2,600forservicesperformed.Paid$200cashforadvertisingstartofthebusiness.Received$1,100cashfromcustomersbilledintransaction(4).Paidcreditor$300cashonaccount.Paiddividendsof$400cashtostockholders.

(a)InstructionsForeachtransactionindicate(a)thebasictypeofaccountdebitedandcredited(asset,liability,stockholders’equity);(b)thespecificaccountdebitedandcredited(Cash,RentExpense,ServiceRevenue,etc.);(c)whetherthespecificaccountisincreasedordecreased;and(d)thenormalbalanceofthespecificaccount.Usethefollowingformat,inwhichtransaction1isgivenasanexample.

Trans-action1

AccountDebited(a)(b)(c)(d)BasicSpecificNormalTypeAccountEffectBalanceAssetCashIncreaseDebit

AccountCredited(a)(b)(c)(d)BasicSpecificNormalTypeAccountEffectBalanceStock-CommonIncreaseCreditholders’stockequity

4.(b)Journalizethetransaction.Donotprovideexplanations.ThisinformationrelatestoMatthewsRealEstateAgencyCorporation.Oct.

(1)Stockholdersinvested$25,000inexchangeforcommonstockofthecorporation.Hiresanadministrativeassistantatanannualsalaryof$42,000.Buysofficefurniturefor$3,600,onassount.(6)SellsahouseandlotforM.E.Mills;commissionsduefromMills,$10,800(notpaidbyMillsatthistime).Receivescashof$140ascommissionforactingasrentalagentrentinganapartment.Pays$700onaccountfortheofficefurniturepurchasedonOctober3.Paystheadministrativeassistant$3,500insalaryforOctober.InstructionsPreparethedebit-creditanalysisforeachtransactionasillustratedonpages119-124.TransactiondataforMatthewsRealEstateAgencyarepresentedin3.Instructions

Journalizethetransaction.Donotprovideexplanations.

SelectedtransactionsforP.F.QuickCorporationduringitsfirstmonthinbusinessarepresentedbelow.Sept.

(1)I

- 配套讲稿:

如PPT文件的首页显示word图标,表示该PPT已包含配套word讲稿。双击word图标可打开word文档。

- 特殊限制:

部分文档作品中含有的国旗、国徽等图片,仅作为作品整体效果示例展示,禁止商用。设计者仅对作品中独创性部分享有著作权。

- 关 键 词:

- 财务会计 会计 英语 复习 练习题

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

冰豆网所有资源均是用户自行上传分享,仅供网友学习交流,未经上传用户书面授权,请勿作他用。

《城市规划基本知识》深刻复习要点.docx

《城市规划基本知识》深刻复习要点.docx